Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

Industry Association Letter on Impact of COVID-19 on Initial Margin Phase-In

Coalition letter on keeping European markets open

Households continue to keep a disproportionate amount of money in bank deposits in most European countries

New report calls for action to be taken to revive the Capital Markets Union project

Household Participation in Capital Markets

This report analyses the progress made in recent years by European households in allocating more of their financial wealth to capital market instruments (pension plans, life insurance, investment funds, debt securities and listed shares) and less in cash and bank deposits. It also includes policy recommendations on improving retail participation in capital markets, including for the Retail Investment Strategy currently under discussion.

Some key findings include:

Buy-side experts worried that mandatory active accounts for EU clearing could increase systemic risks, not lower them

EFAMA is pleased to share the link to the educational webinar it organised on 14 June with leading buy-side clearing experts, including Allianz Global Investors, Aviva Investors, BlackRock and Nordea Asset Management, to discuss the main findings of EFAMA's recent analysis on mandated active accounts for EU clearing.

Household Participation in Capital Markets

This report analyses the progress made in recent years by European households in allocating more of their financial wealth to capital market instruments (pension plans, life insurance, investment funds, debt securities and listed shares) and less in cash and bank deposits. It also includes policy recommendations on improving retail participation in capital markets, including for the Retail Investment Strategy currently under discussion.

Some key findings include:

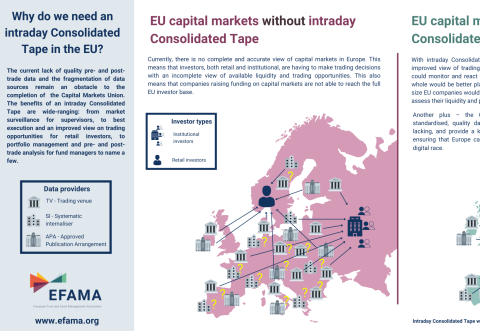

Buy-side use-cases for a real-time consolidated tape

A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues.

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.