Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

Industry Association Letter on Impact of COVID-19 on Initial Margin Phase-In

Coalition letter on keeping European markets open

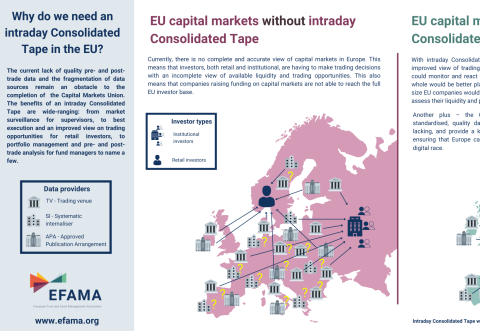

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

UK clearing house equivalence - request from nine trade associations

Nine associations (AFME, AIMA, EAPB, EBF, EFAMA, FIA, ICI, ISDA, SIFMA AMG) welcome the Commission's decision to grant a time-limited equivalence decision in respect of UK CCPs. However, when this time-limited equivalence decision expires on 30 June 2022, there remains a significant risk of disruption to clearing for EU firms and to their access to global markets.

Joint association letter on the CSDR Settlement Discipline implementation timeline

On 14 July 2021, sixteen trade associations, representing buy-side, sell-side and market infrastructures, wrote to ESMA and the European Commission regarding the timeline for implementation of the mandatory buy-in rules as part of the CSDR Settlement Discipline Regime.

The Joint Associations welcome the Report from the Commission on the CSDR Review published in July 2021 and fully support the Commission’s intention to consider amendments to the mandatory buy-in regime, subject to an impact assessment.

Closet Index Funds

EFAMA has reviewed ESMA’s statement “Supervisory work on potential index tracking”, which sets out research to determine whether any indication of closet indexing could be found at EU level. To contribute to the debate on this matter, EFAMA has prepared a paper, which highlights the limits of identifying closet index funds through a statistical analysis, drawing on recently published research papers.