EFAMA commends the efforts of the Czech Presidency and Member States in reaching an agreement on the review of MiFIR/MiFID. EFAMA members welcome the Council position which unequivocally comes down on the side of competitive, globally attractive markets, driven by diversity and innovation and the right tools and infrastructures to support the retail investor.

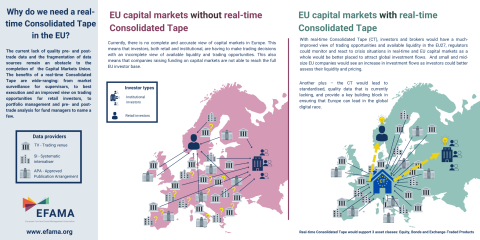

EFAMA members breathe a collective sigh of relief as this agreement moves us closer to a firm roadmap to deliver a real-time consolidated tape for equities, and builds the foundations for real-time pre-trade equity data. The provisions for a bond tape are equally welcome, though we highlight the importance of appropriate deferral periods for the larger less liquid trades, and a fair revenue-sharing mechanism for data contributors that does not include open-ended provisions for ‘loss of revenue’.

The agreement also rightfully addresses another looming problem in Europe: the cost of market data. In that respect we are pleased to see the strengthening of the Reasonable Commercial Basis principle in the Council text. We would also urge the co-legislators to anticipate similar cost/competition issues by proposing a robust governance framework to future-proof access and fair pricing of data.

A single volume cap set at 10% simplifies the equity market transparency regime, while preserving diversity of trading options for all investors. On the question of the payment to brokers for routing orders (Payment for Order Flow), we believe that before either contemplating a full ban, or allowing the practice with appropriate restrictions to protect the retail investor, an in-depth analysis should be carried out to assess the real impact of PFOF on price formation, liquidity, retail investor participation and ability to execute at the best available price. Such an impartial study on the European market is lacking today.

Brussels, 21 December 2022