The role of asset management

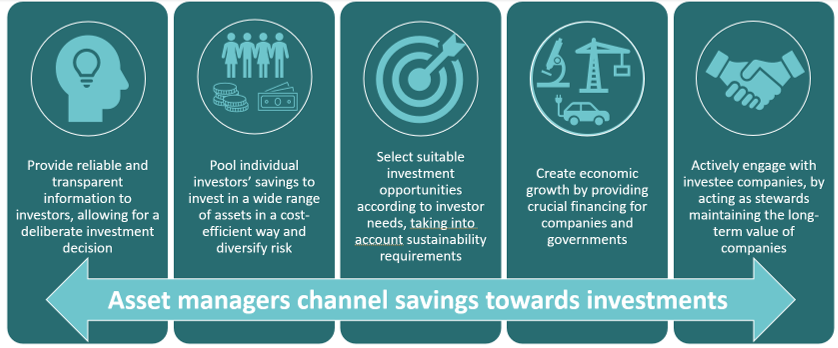

The core mission of an asset manager is to invest the money of European citizens and institutional clients into productive economic activities. The proceeds from this are then returned to savers and pensioners, helping them achieve their financial goals like paying for education or retirement.

By investing their clients’ savings, asset managers also contribute to the well-being of the economy, notably by providing financing for companies and governments and by playing a key role in the transition towards a sustainable economy.

Thanks to its many individual and societal benefits, asset management has enjoyed steady growth over the last decades and has become an important pillar of the financial sector, alongside banks and insurance companies, as well as a provider of hundreds of thousands of highly qualified jobs throughout Europe.

Asset managers provide a wide range of individual and collective investment options corresponding to different investment strategies, objectives, time horizons and risk profiles to match their clients’ needs and preferences, with the ultimate goal to achieve positive returns over the long term and to protect their savings against inflation.

Individual investors typically access asset management services by putting their money into investment funds. An investment fund is a financial product created by an asset management company for the purpose of raising capital from a number of investors and investing it collectively in a portfolio of assets. In Europe, investment funds are strongly regulated and supervised products offering a high degree of protection to their investors.

By pooling the assets of many individual clients into a single portfolio, investment funds offer multiple benefits to their investors, even when investing only small amounts They give them affordable access to professional management of their savings, the possibility to invest in a diversified portfolio of assets and to get exposure to specific asset types that would otherwise be out of reach. Investment funds also take full advantage of economies of scale whereby asset managers can secure better prices and lower trading costs.

In return for those professional services, asset managers charge a yearly fee, generally expressed as a percentage of the value of the assets they manage, in such a way as to align both investors' and managers' long-term interests.

Read our top tips for getting started with investing:

Asset managers bridge the gap between savings and investment opportunities, linking investors with companies and driving the shift to a sustainable economy. Due to their diverse goals, strategies, and timeframes, they impact the market in various ways.

Companies seeking funds for their operations can issue bonds and stocks in capital markets. Asset managers then buy these on behalf of investors, either from the company directly (primary market) or from other investors (secondary market). This important intermediary role provides a vital source of funding and liquidity for new projects and generates returns for millions of investors.

Asset managers are important players in the financial system, ensuring that buying, selling and price setting within capital markets happens smoothly. This ultimately helps the economy grow and become healthier. The better European capital markets work, the more international investors will also want to invest their money into European businesses.

Asset managers help protect investments by spreading them out across various types of stocks, bonds and other financial products. This diversification is especially important at times of economic uncertainty and high inflation. Investments spread across numerous geographies, sectors, and asset classes help to cushion the impact of market shocks and inflation on the investment portfolio.

To make smart investment choices, asset managers use research, databases and other tools to monitor the industries, countries, and regions in which they invest. Their goal is to screen out poor investments and find those that are advantageous and consistent with the pre-defined risk profile of the portfolio.

As awareness of the threats posed by climate change and social inequality increase, more and more people want investments that help the environment and society while providing financial returns. Asset managers offer a range of solutions to help investors support positive change in various ways.

By providing funding for new sustainable projects or technologies, asset managers can support companies that have a positive impact on people and the planet. This generally involves buying green bonds or newly issued shares on the primary market.

In addition, asset managers actively engage with the companies they invest in to improve the sustainability of their activities. This can happen through voting at shareholder meetings, discussions with management, public pressure, and even taking board seats. When they maintain a constructive and ongoing dialogue with these companies, they can give specific recommendations, set regular follow-up, and better understand how the company aligns with investors’ ESG goals.

Also, by buying shares of ‘green’ or ‘transitional’ companies, asset managers can cause the valuations of such companies to go up, thereby reducing their future cost of financing.

To identify companies and governments committed to sustainable development, asset managers rely on ESG rating and data providers, proprietary in-house ESG ratings, as well as analysts to evaluate the performance of companies and issuers on a wide range of ESG criteria.

Read our brochure explaining sustainable investing:

https://www.efama.org/newsroom/news/sustainable-investing-explained-9-questions

Asset managers serve two main groups of clients: retail and institutional. Retail clients include regular households and high-net-worth individuals. Institutional clients include pension funds, insurance companies and others like charities, foundations, holding companies and large businesses. These institutional clients control large amounts of financial assets and often hire external asset managers to help them manage their assets.

There are several reasons why institutional investors use asset managers. The costs of managing investments in-house continue to increase while asset management fees are declining. Asset managers handle day-to-day investment decisions so the client can focus on other things. Also, as rules and requirements get stricter, they benefit from economies of scale in managing portfolios, risk, and research. Institutional investors do not need to spend on things like data, analysis, technology, and reporting. Asset managers take care of these for multiple clients at the same time.

The level of direct employment in asset management companies is another important measure of the contribution of the industry to the overall economy. Based on data collected from EFAMA members, we estimate that around 120,000 individuals are directly employed by the asset management industry across Europe.

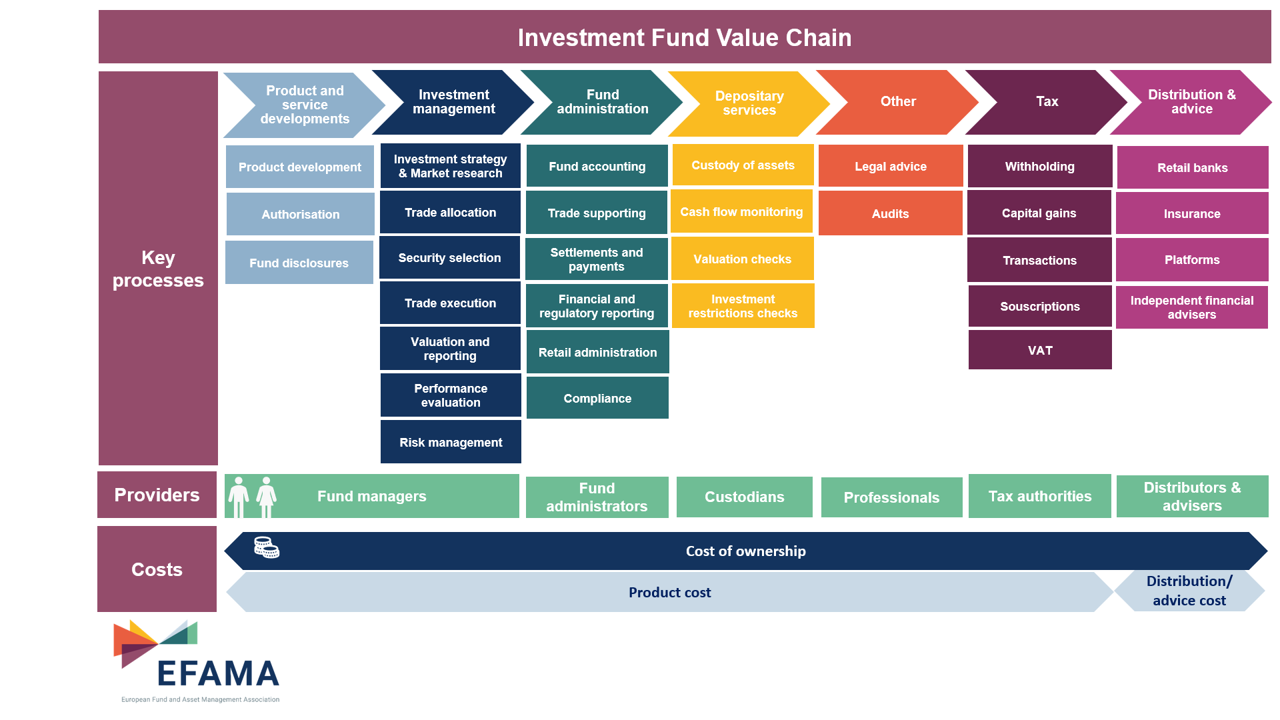

When looking at the overall employment generated by the asset management industry, it is important to consider the indirect employment linked to fund distribution, which remains mostly handled by banks and financial advisors. Related services and support functions, such as accounting, auditing, custodianship, IT, legal, marketing, research and FinTech, should also be factored in. Taking into account all these related services along the asset management value chain, we estimate that European asset managers, and all the firms providing services to the asset management industry, generate some 670,000 full-time equivalent jobs.

The image below shows the services offered by various providers along the investment fund value chain. This includes product development, investment management, fund administration, depositary services, tax, distribution and advice, and more. It's important to know that these services are all closely regulated to ensure protection and fair treatment of the investors.