Our Committees

Our Standing Committees are the living heart of EFAMA’s policy and regulatory work, where members regularly meet to exchange information and ideas, to discuss and form industry views on policy initiatives and new regulation, with a view to shape and support EFAMA’s advocacy on behalf of the European asset management industry.

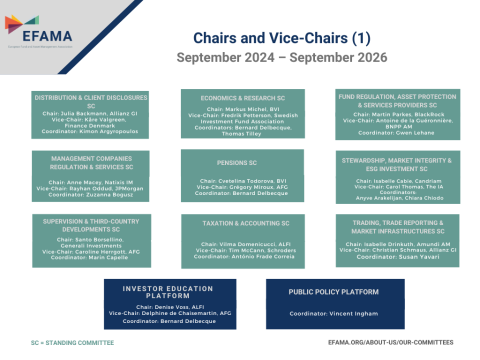

Committee Chairs and Vice-chairs are appointed by the Board for a 2-year term, upon a recommendation by the Board's Advisory Committee.

This Standing Committee focuses on fund distribution and disclosures to investors. These include investor protection and disclosure issues arising from the evolving PRIIPs and MiFID frameworks, the shift towards digital distribution tools, and the continued integration of ESG considerations into fund products.

EFAMA coordinator: Kimon Argyropoulos

Chair: Julia Backmann, Allianz Global Investors (DE)

Vice-chair: Kåre Valgreen, Finance Denmark (DK)

This Standing Committee reviews the draft reports prepared by EFAMA’s in-house research team. It provides insights on relevant national developments and expert industry views. The Committee also acts as a driving force for strengthening EFAMA’s research capabilities, in particular in the area of data, to support our advocacy activities.

EFAMA coordinators: Daniel Irwin-Brown, Thomas Tilley

Chair: Markus Michel, BVI (DE)

Vice-chair: Fredrik Pettersson, Swedish Investment Fund Association

Taskforce: European Fund Classification (Coordinator: Thomas Tilley)

Chair: Miranda Seath, The IA (UK)

Taskforce: Fund Charges and Performance (Coordinator: )

Chair: Agathi Pafilli, Capital Group (LU)

Taskforce: Member Contributions (Coordinator: Thomas Tilley)

Chair: Serge Weyland, ALFI (LU)

This Standing Committee monitors and analyses fund product regulation such as UCITS, AIF and ELTIF, as well as developments related to EU asset protection rules. Service providers for investment fund products also fall within the remit of this Committee and an additional three Taskforces.

EFAMA coordinator: (vacant)

Chair: Martin Parkes, BlackRock (UK)

Vice-Chair: Antoine de la Guéronnière, BNPP AM (FR)

Taskforce: ETFs (Coordinator: Federico Cupelli)

Chair: Jim Goldie, Invesco (UK)

Taskforce: Money Market Funds (Coordinator: Federico Cupelli)

Chair: Thierry Darmon, Amundi AM (FR)

Taskforce: Benchmarks (Coordinator: vacant)

Chair: Piotr Giemza-Popowski, Arendt (LU)

This Standing Committee looks at topics related to management companies’ activities and services, prudential requirements for asset managers, and financial stability issues relevant for the sector. The Committee’s been particularly active in the area of risk management, which has proven extremely valuable during the Covid-19 pandemic.

EFAMA coordinator: Zuzanna Bogusz

Chair: Anne Macey, Natixis IM (FR)

Vice-chair: Rayhan Oddud, J.P.Morgan AM (UK)

Taskforce: Anti-money laundering (Coordinator: Zuzanna Bogusz)

Chair: Giovanni Cataldi, Alliance Bernstein (LU)

Subgroup: Operational Resilience (Coordinator: Zuzanna Bogusz)

This Standing Committee is responsible for developing EFAMA’s positions on pension issues. In recent years, the Committee has focused its activities on the pan-European Personal Pension Product (PEPP) and provided input to the European Commission and EIOPA to contribute to the design of a successful PEPP. The Committee also keeps an eye on the IORP Directive, which is due to be reviewed by January 2023.

EFAMA coordinator: Kimon Argyropoulos ad interim

Chair: Cvetelina Todorova, BVI (DE)

Vice-chair: Grégory Miroux, AFG (FR)

This Standing Committee works towards mainstreaming sustainability into asset managers’ business, through the integration of ESG considerations in investment decisions and strengthening firms’ role as stewards of investee companies. Its members follow the development of EU sustainable finance policy initiatives on transparency and disclosures, ESG data, sustainable corporate governance, standards and labels.

EFAMA coordinator: Anyve Arakelijan

Chair: Isabelle Cabie, Candriam (BE)

Vice-chair : Carol Thomas, The IA (UK)

Workstream: SFDR & Taxonomy (Coordinator: Anyve Arakelijan)

Chair: Magdalena Kuper , BVI (DE)

Workstream: Stewardship & Corporate Sustainability (Coordinator: Ilia Bekou)

Chair: Alessia Di Capua, Assogestioni (IT)

Workstream: Sustainable Data & Reporting (Coordinator: Ilia Bekou)

Chair: Laurence Caron Habib, BNP Paribas AM (FR)

Taskforce: Common Ownership (Coordinator: Zuzanna Bogusz)

This Standing Committee focuses on the evolution of EU supervisory rules over asset management entities, falling essentially within the remit of ESMA. The committee also monitors major non-EU, third-country developments with an impact on European fund management companies, such as U.S.-related developments, Brexit implications/equivalence determinations and regional passporting initiatives.

EFAMA coordinator: Marin Capelle

Chair: Santo Borsellino, Generali Investments (IT)

Vice-chair: Caroline Herrgott, AFG (FR)

Workstream: Supervision & Better Regulation

Chair: Santo Borsellino

Workstream: International Developments

Chair: Caroline Herrgott

This Standing Committee discusses all relevant tax topics with importance to the European asset management industry. The focus lays on mainstream funds; when of broad relevance, we may discuss alternative investment fund tax-related issues, such as Tax transparency packages or EU FTT.

EFAMA coordinator: António Frade Correia

Chair: Vilma Domenicucci, ALFI (LU)

Vice-chair: --

Taskforce: VAT (Coordinator: António Frade Correia)

Chair: Gert-Jan Van Norden, DUFAS/KPMG (NL)

Taskforce: Blockchain for Taxes (Coordinator: António Frade Correia)

Chair: Pat Convery, Irish Funds/PwC (IRL)

Taskforce: Accounting (Coordinator: António Frade Correia)

Chair: Maulik Mehta, BlackRock (UK)

This Standing Committee oversees matters relating to that asset managers’ buy-side role in financial markets. It seeks to protect the interests of the end-investors by promoting fair, efficient, and transparent investment markets, supported by robust, well-regulated market infrastructures to ensure financial stability. MiFID/MiFIR, EMIR, CSDR or SFTR are among the key files under the remit of the Committee.

EFAMA coordinator: Susan Yavari

Chair: Isabelle Drinkuth, Amundi AM (FR)

Vice-chair: Christian Schmaus, Allianz GI (DE)

Taskforce: Trade and Transaction Reporting Standards (Coordinator: Susan Yavari)

Chair: --

Taskforce: Artificial Intelligence (Coordinator: Franco Luciano)

Chair: Ulf Herbig, Kneip (LU)

Taskforce: Tokenisation (Coordinator: Susan Yavari)

Chair: Christophe Hock, Union Investment (DE)

Taskforce: Derivatives and Clearing (Coordinator: Franco Luciano)

Chair: Dana Coey, Schroders (UK)

The Platform is responsible for EFAMA’s activities in financial and investor education. It limits its focus to select projects likely to have a material impact, such as the sponsorship of a financial literacy committee set up by the European Youth Parliament, the preparation of a new publication to highlight principles for saving and investing for millennials, and an update on industry driven investor education initiatives.

EFAMA coordinator: António Frade Correia ad interim

Chair: Denise Voss, ALFI (LU)

Vice-chair: Delphine de Chaisemartin, AFG (FR)

The EU decision-making process at times requires that industry swiftly reacts to the latest policy developments. Our Public Policy Platform (PPP) plays a key role in providing this rapid response, sharing the latest intelligence and coordinating timely and effective advocacy strategies. Testament to the PPP’s value-add is the sharp rise in the participating members since its inception. The PPP allows us to leverage the networks of our members, amplifying EFAMA’s reach and effectiveness.

EFAMA coordinator: Vincent Ingham