Our associations are committed to supporting the transition to a more sustainable economy and

to tackling climate change that we consider a priority. We strongly support the EU objective of

transforming Europe into the first climate-neutral continent in the world by 2050 and are ready

to contribute as representatives of the financial sector.

Sustainability-related disclosures (SFDR)

Regulation (EU) 2019/2088 on sustainability-related disclosures (SFDR) is a pillar of the EU sustainable finance agenda. SFDR aims to increase the transparency of financial market participants towards end-investors and contribute to the objective of fighting greenwashing. It lays down sustainability disclosure obligations on the environmental and social impact of an entity’s investment decisions, and requirements on how to present the characteristics of green investment products.

To ensure this new set of rules successfully delivers on its objectives, EFAMA contributes to developing the regulation, as well as assisting members’ implementation efforts. We voice any concerns around the timelines for applying rules, implementation challenges and interpretation issues. Additionally, we provide the industry’s informed views on current risk management frameworks and practices concerning the disclosure of information to end-investors.

Joint industry letter - Call for a centralized register for ESG data in the EU

Feedback on the development of delegated regulation on climate change mitigation & adaptation

EFAMA comments European Commission's Proposal on disclosures relating to sustainable investments

IOSCO´s consultation on ESG ratings and data products providers

Given the increasingly important role ESG ratings and data products providers play in investment processes, EFAMA welcomes the increased attention of regulators to this issue. In light of the growing regulatory scrutiny on the ESG characteristics of potential investments, improving the usability and reliability of the ESG ratings and data products is a key priority for the European asset management industry.

EFAMA responds to IOSCO's recommendations on sustainability-related practices policies, procedures and disclosures in asset management

EFAMA welcomes IOSCO's enhanced attention to transparency efforts supporting informed and qualified investment decisions in sustainability-related products. We support the adoption of such recommendations at the international level and believe IOSCO should leverage the experience with SFDR and Taxonomy in Europe to help establish consistent international standards, definitions and best practices.

In this response, we would like to highlight three pressing challenges deserving greater attention in the report from asset managers' perspective.

EFAMA welcomes proposed transitional period under Art. 8 of the taxonomy and calls for its alignment with SFDR taxonomy-related product disclosures

EFAMA has published its response to a consultation on the draft delegated act under Article 8 of the Taxonomy.

EFAMA’s latest Market Insights shows fluctuations in the SFDR fund market and makes policy recommendations for the future | Issue # 12

EFAMA has released today a new issue of its Market Insights series titled “The SFDR fund market – State of play, latest market developments and outstanding regulatory issues ”.

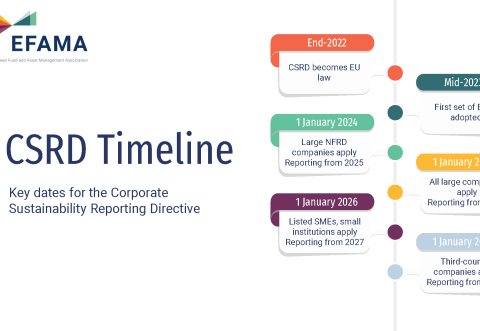

Infographic | The CSRD Timeline

Key dates for the Corporate Sustainability Reporting Directive

Mandatory European sustainability reporting standards are crucial as insufficient availability of ESG data is a key impediment to realising the full potential of the EU’s sustainable finance regulatory framework. As information preparers under the Sustainable Finance Disclosure Regulation (SFDR), asset managers will undoubtedly benefit greatly from relevant, comparable, reliable and public ESG metrics of companies’ activities and financial risks.

The European ESG market in Q1 2021 – Introducing the SFDR | Market Insights | Issue #7

This report breaks down the size of the European ESG market, reviewing the assets under management of funds using the SFDR (Sustainable Finance Disclosure Regulation) framework.