EFAMA has some concerns with ESMA’s clarifications. In the consultation paper (CP), ESMA seems to have a very broad interpretation of the ‘multilateral systems’ definition under MiFID II and states that ‘systems where trading interests can interact but where the execution of transactions is formally undertaken outside the system still qualify as a multilateral system and should be required to seek authorisation’ (paragraph 36).

MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

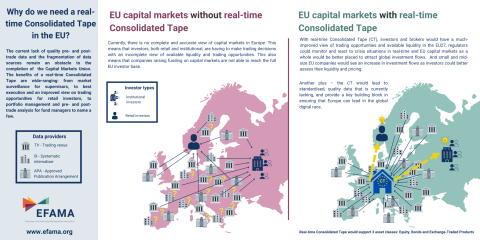

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA's reply to ESMA's CP on MiFIR Review report on the obligations to report transactions & reference data

We disagree with an extension of its scope to UCITS’ and AIFs’ management companies to the scope of the reporting requirements imposed by MiFIR, Art. 26. This extension would be in breach of the principle of proportionality, as:

EFAMA comments EC CP on a Covid-19 Capital Markets Recovery Package

EFAMA appreciates the Commission's efforts in pursuing an alleviation of certain MiFID II requirements in the interest of promoting a swift recovery from the economic crisis precipitated by the Covid-19 pandemic (....).

EFAMA believes however that there are more effective ways to foster SME access to markets and urges the Commission to consider a set of further measures (...)

Investment Funds Distributor Due Diligence Questionnaire

Funds face unique challenges in performing intermediary oversight, and especially so because of MiFID II requirements, changing regulatory landscapes, and the absence of an industry agreed-upon standard between funds and their distribution channels. To help address these challenges, a dedicated working group developed a uniform due diligence questionnaire (DDQ) that will serve as the standard for investment funds (UCITS and AIFs) in performing onboarding and ongoing oversight of distribution channels.

EFAMA calls for changes to investor protection rules in MIFID II / MIFIR Review

EFAMA has submitted its  response to the European Commission's consultations on the review of the MIFID II / MIFIR regulatory framework, where it has outlined its recommendations on investor protection and capital markets and infrastructure.

response to the European Commission's consultations on the review of the MIFID II / MIFIR regulatory framework, where it has outlined its recommendations on investor protection and capital markets and infrastructure.

EFAMA's Director General Tanguy van de Werve commented: