In light of the current COVID-19 circumstances and the already existing ambitious time table for the implementation, EFAMA calls for the EBA to carefully consider these circumstances and request the EC to postpone the date for the application of the IFD/IFR framework (26 June 2021) and the time table of the level 2 measures (such as the deadline of 26 December 2020 for providing drafted RTS and ITS).

Management Companies

EFAMA has been looking at legislative proposals with a direct impact on asset management companies and services, and closely follows any regulatory developments of critical importance to the sector. In addition to issues related to risk management and financial stability, high up on the agenda of EFAMA members is the framework for a prudential regime for Investment Firms (IFD/R), and related implementing measures directly descending from such framework.

EFAMA is focused on minimising the impact of the rules on asset management companies, in particular those holding a limited MiFID license. Key to the sector is the need for proportionality, especially firms that are not authorised to hold client money/securities, or to deal on their own account.

EFAMA responds to EBA CPs on implementation measures of new regulatory framework for Investment Firms

EFAMA Reply to consultation for an EC Action Plan to prevent money laundering and terrorist financing

As highlighted in President’s von der Leyen guidelines for the new Commission, the complexity and sophistication of the Union’s financial system has opened the door to new risks of money laundering and terrorist financing. The European Union needs to step up its regulatory framework and preventive architecture to ensure that no loopholes or weak links in the internal market allow criminals to use the EU to launder the proceeds of their illicit activities.

Associations Letter: Integration of sustainability factors and risks into MiFID II IDD and Solvency II

FSB consultation on liquidity preparedness for margin calls in non-bank financial intermediation

EFAMA agrees with the FSB that market participants should integrate the management of margin and collateral calls into their risk management, governance, and operational processes.

EFAMA’s position on the EC's review of the AIFM and UCITS directives

We welcome the targeted approach of the Commission in its review, recognising the overall success of the frameworks over the past decade.

Annual European Asset Management Report - Report highlights key developments in the European fund industry

The European Fund and Asset Management Association (EFAMA) has released the 13th edition of its Asset Management in Europe report, which provides in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

Asset Management Report 2021

This is our 13th edition of the Asset Management in Europe report, which provides an in-depth analysis of recent trends in the European asset management industry, focussing on where investment funds and discretionary mandates are managed in Europe.

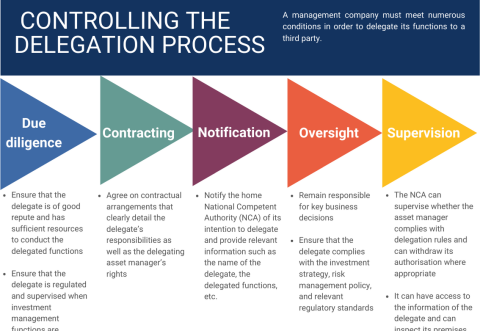

Infographic | The delegation process

The AIFMD is one of the pillars of EU regulation for investment funds, which will be crucial to the development of the Capital Markets Union (CMU) and the post Covid-19 economic recovery in the European Union. One subject that the AIFMD covers is the delegation process. We created the below infographic to shine a light on how delegation works under the current AIFMD, including how the delegation process is controlled, what activities can be delegated and what the benefits of delegation are for end investors and the asset management industry.

EFAMA Annual Review 2020-2021

It gives me great pleasure to provide you with an overview of our activities since our Ordinary General Meeting of last year.