EFAMA has today published its International Quarterly Statistical Release regarding the developments in the worldwide investment fund industry during the first quarter of 2023.

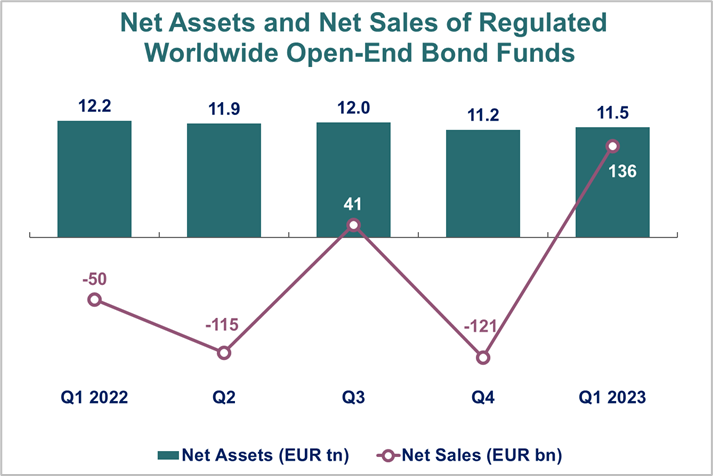

Bernard Delbecque, Senior Director for Economics and Research, commented “Following one of their worst years in history, bond funds enjoyed a strong rebound in net sales and net assets in Q1 2023, as investors took advantage of the relatively high level of interest rates and bond yields, which significantly reduced the risk of further falls in bond prices.”

The main developments through Q1 2023 are as follows:

- Net assets of worldwide investment funds increased by 3% in euro terms.

- Net assets of worldwide investment funds reached EUR 62.42 trillion in Q1 2023. Measured in US dollar terms, the net assets rose to USD 67.9 trillion at the end of Q1 2023, a 5% growth compared to the previous quarter.

- Measured in local currency, net assets in the two largest fund markets, the United States and Europe, increased by 5.9% and 2.6%, respectively.

Net investment fund assets increased both in Europe and the United States thanks to a combination of net inflows and the overall positive performance of financial markets.

- Net sales of long-term funds shifted back into positive territory in Q1 2023.

- Worldwide long-term funds recorded net inflows of EUR 132 billion, compared to net outflows of EUR 198 billion in Q4 2022. Europe experienced the highest net inflows of EUR 73 billion, followed by the United States with EUR 55 billion, and the Asia-Pacific region with EUR 13 billion.

- Global equity funds saw a turnaround with net inflows of EUR 4 billion, compared to net outflows of EUR 51 billion in Q4 2022. Japan and Ireland registered the highest net sales (EUR 22 billion and EUR 19 billion, respectively), whereas the bulk of net outflows occurred in the United States (EUR 39 billion).

- Bond funds recovered as well, with net inflows of EUR 136 billion, compared to net outflows of EUR 121 billion in Q4 2022. The United States and Europe accounted for the majority of net sales, EUR 95 billion and EUR 52 billion, respectively.

- Multi-asset funds sustained net outflows of EUR 45 billion, marking the fourth consecutive quarter of negative net sales. China accounted for most of these net outflows (EUR 18 billion).

Long-term funds experienced a positive shift in net sales, driven by strong performance in bond funds.

- Global money market funds rose to a record not seen since Q1 2020.

- Worldwide money market funds (MMFs) recorded net inflows of EUR 534 billion, up from EUR 325 billion in Q4 2022.

- In Europe net inflows of MMFs declined to EUR 11 billion in Q1 2023, compared to EUR 170 billion in Q4 2022.

- MMFs in the United States attracted very high net inflows (EUR 432 billion), a substantial increase from EUR 183 billion in Q4 2022, as many investors shifted their money from bank deposits to MMFs in reaction to the Silicon Valley Bank’s collapse.

- In China, MMFs registered net inflows of EUR 68 billion, compared to net outflows of EUR 34 billion in Q4 2022.

Net sales of worldwide MMFs were very high in Q1 2023, primarily due to unusually strong net inflows in the United States.

-- ends --

About the EFAMA Quarterly International Statistical Releases:

The EFAMA Worldwide Investment Fund Assets and Flows quarterly release focuses on net assets and net sales of worldwide investment funds, whilst also presenting a commentary on the trends in the industry during the quarter. The report contains data on the largest domiciles of investment funds around the globe and the position of Europe in the worldwide context. The report contains statistics from the following 46 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Republic of Korea, New Zealand, Pakistan, Philippines, Taiwan, and South Africa.