Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

Joint trade association advocacy paper on equity option margin exemption under EMIR 3

Cross-Industry Consensus on EU Equity Consolidated Tape

EFAMA, AFME, BVI and Cboe Europe Agree Cross-Industry Consensus on EU Equity Consolidated Tape

Monday 30 May, 2022 - AFME, BVI, Cboe Europe and EFAMA have today jointly published a position paper which provides a set of key principles needed to ensure the successful creation of an EU Equity Consolidated Tape (CT).

EU Equity Consolidated Tape Proposal - Statement of Principles

A Cross-Industry Consensus on the EU Equity Consolidated Tape Proposal - Statement of Principles

EFAMA, AFME, BVI and Cboe agreed on a set of 11 Principles.

The provision of an appropriately constructed EU Equities Consolidated Tape (“CT”) will democratise access to equities (as proposed by the EU Commission) for all investors, regardless of resources or sophistication, with a comprehensive and standardised view of EU equities prices.

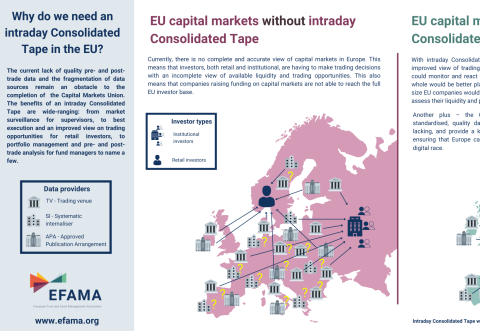

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

UK clearing house equivalence - request from nine trade associations

Nine associations (AFME, AIMA, EAPB, EBF, EFAMA, FIA, ICI, ISDA, SIFMA AMG) welcome the Commission's decision to grant a time-limited equivalence decision in respect of UK CCPs. However, when this time-limited equivalence decision expires on 30 June 2022, there remains a significant risk of disruption to clearing for EU firms and to their access to global markets.

Joint association letter on the CSDR Settlement Discipline implementation timeline

On 14 July 2021, sixteen trade associations, representing buy-side, sell-side and market infrastructures, wrote to ESMA and the European Commission regarding the timeline for implementation of the mandatory buy-in rules as part of the CSDR Settlement Discipline Regime.

The Joint Associations welcome the Report from the Commission on the CSDR Review published in July 2021 and fully support the Commission’s intention to consider amendments to the mandatory buy-in regime, subject to an impact assessment.