EFAMA has today published its International Quarterly Statistical Release regarding the developments in the worldwide investment fund industry during the fourth quarter of 2022.

Bernard Delbecque, Senior Director for Economics and Research, commented “Although financial markets recovered somewhat in Q4 2022, investors remained cautious during the quarter, resulting in continued net outflows from long-term funds and strong net sales of MMFs.”

The main developments through Q4 2022 are as follows:

- Net assets of worldwide investment funds decreased by 2.2% in euro terms.

- The fourth quarter of 2022 saw a decrease of 2.2% in net assets of worldwide investment funds to EUR 61 trillion. Measured in US dollar terms, net assets increased by 7% due to the significant depreciation of the US dollar vis-à-vis the euro.

- Measured in local currency, net assets in the two largest fund markets, the United States and Europe, increased by 5.6% and 0.9%, respectively.

Worldwide net fund assets declined a little in Q4 2022, despite an upswing in financial markets, as the euro appreciated vis-à-vis the US dollar.

- Net sales of long-term funds remained negative.

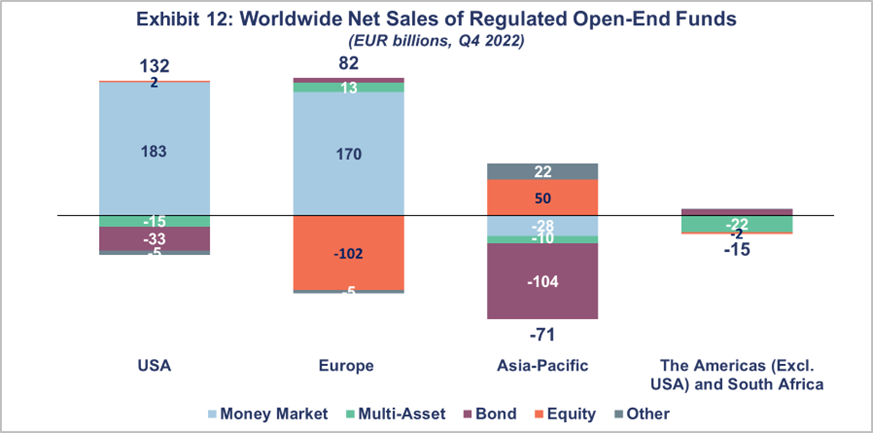

- Worldwide long-term funds experienced significant net outflows of EUR 197 billion in the fourth quarter of 2022, compared to net outflows of EUR 60 billion in Q3 2022. All the regions registered net outflows from long-term funds. Europe and the United States recorded net outflows of EUR 88 billion and EUR 51 billion, respectively. The Asia-Pacific region also witnessed net outflows of EUR 43 billion, while the Americas recorded net outflows of EUR 15 billion.

- Equity funds experienced net outflows of EUR 52 billion, compared to net outflows of EUR 81 billion in Q3 2022. Europe’s equity funds experienced significant net outflows driven by equity AIF closing in the Netherlands (EUR 87 billion). However, Asia-Pacific recorded positive net sales of equity funds amounting to EUR 50 billion, mainly in China (EUR 26 billion) and Japan (EUR 20 billion).

- Net sales of bond funds turned negative (EUR 122 billion), compared to net inflows of EUR 41 billion in Q3 2022. China accounted for the bulk of net outflows (EUR 91 billion), while bond funds in the United States also recorded a negative amount of EUR 33 billion.

- Multi-asset fund recorded net outflows of EUR 35 billion, compared to the net outflows of EUR 49 billion in Q3 2022. Brazil (EUR 19 billion) and the United States (EUR 15 billion) registered net outflows, while Europe recorded EUR 13 billion in net inflows, mainly driven by positive sales in Germany (EUR 34 billion) and the Netherlands (EUR 6 billion).

Investors remained cautious in Q4 2022, resulting in net outflows of long-term funds across regions worldwide.

- Net sales of money market funds increased significantly.

- Worldwide money market funds (MMFs) registered remarkable net inflows of EUR 325 billion, up from EUR 17 billion in Q3 2022.

- In the United States, MMFs continued to experience strong net inflows (EUR 183 billion), up from EUR 27 billion in Q3 2022.

- In Europe, MMFs also registered notable net inflows (EUR 170 billion), mainly driven by Ireland (EUR 78 billion), France (EUR 42 billion), and Luxembourg (EUR 40 billion), compared to net outflows of EUR 19 billion in Q3 2022.

- Net sales of MMFs were negative in the Asia-Pacific region due to significant net outflows from China (EUR 34 billion), but India and Japan registered net inflows of EUR 5 billion and EUR 2 billion, respectively.

Net sales of worldwide MMFs increased in Q4 2022, primarily thanks to solid net inflows in Europe and the United States.

-- ENDS --

About the EFAMA Quarterly International Statistical Releases:

The EFAMA Worldwide Investment Fund Assets and Flows quarterly release focuses on net assets and net sales of worldwide investment funds, whilst also presenting a commentary on the trends in the industry during the quarter. The report contains data on the largest domiciles of investment funds around the globe and the position of Europe in the worldwide context. The report contains statistics from the following 46 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Republic of Korea, New Zealand, Pakistan, Philippines, Taiwan, and South Africa.

For further information, please contact:

Hayley McEwen

Tel: +32 2 548 26 52

Email: Hayley.McEwen@efama.org