Report highlights developments in the European fund industry in 2019 and shines a spotlight on the growing market for cross border funds.

The European Fund and Asset Management Association (EFAMA), has published its 2020 industry Fact Book. The 2020 Fact Book provides an in-depth analysis of trends in the European fund industry as well as international level, focusing on the U.S., other advanced economies and emerging markets.

The publication contains a detailed overview of the developments in the investment fund market in 29 European countries, including detailed net sales data for the period from 2015 to 2019 and information on recent regulatory developments in each jurisdiction.

A new section covers the demand for funds at national level and per investor type, the share of local and cross-border funds held in each country, and the sales of funds outside Europe. It also highlights the continuous growth of the cross-border funds market and points to overall low investment fund ownership by European households

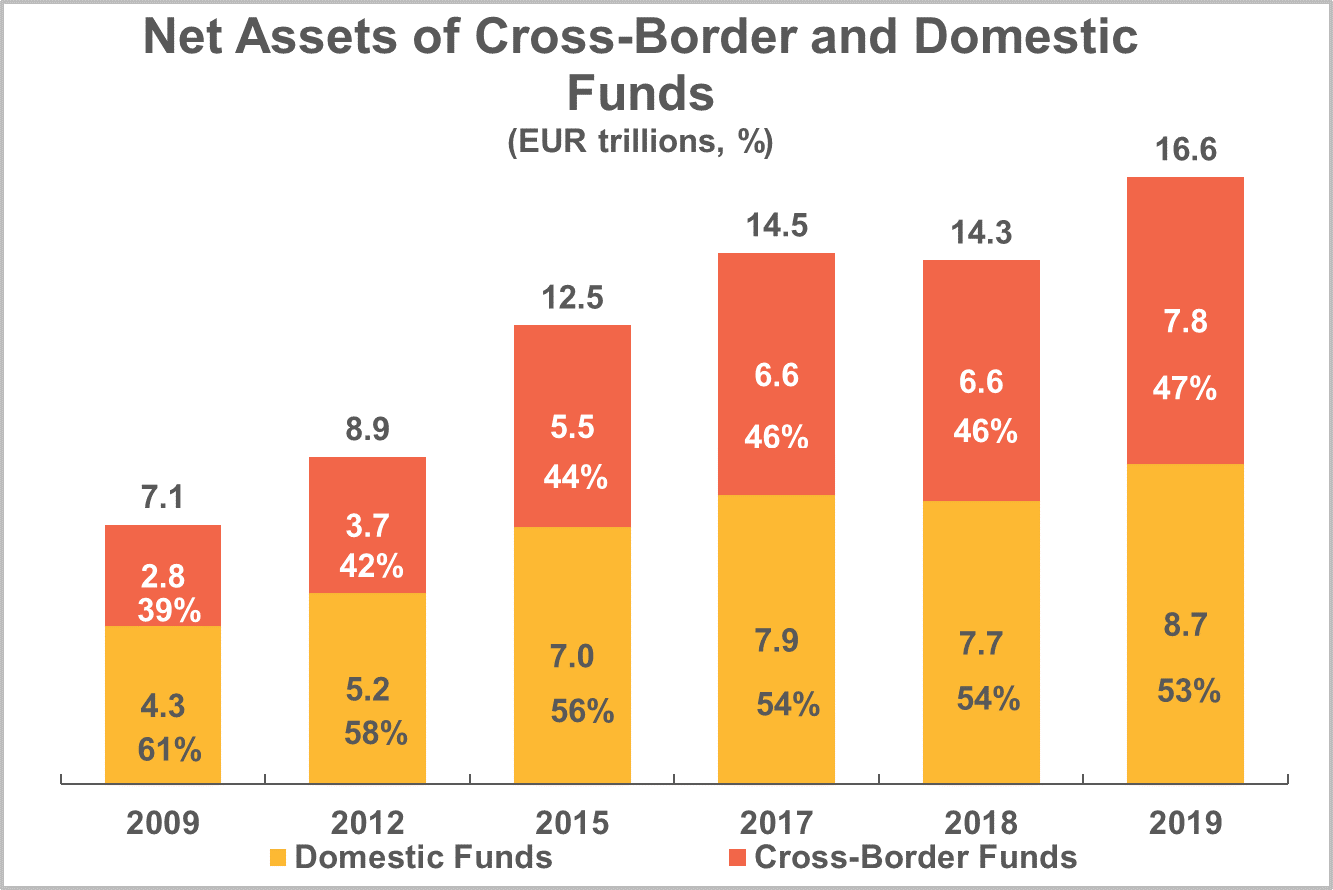

Net assets of cross-border funds have grown significantly over the last decade, from EUR 2.8 trillion in 2009 to EUR 7.8 trillion at the end of 2019. In recent years, this growth has been driven by strong net sales of cross-border funds outside of Europe, accounting for about half of total fund sales in 2018 and 2019.

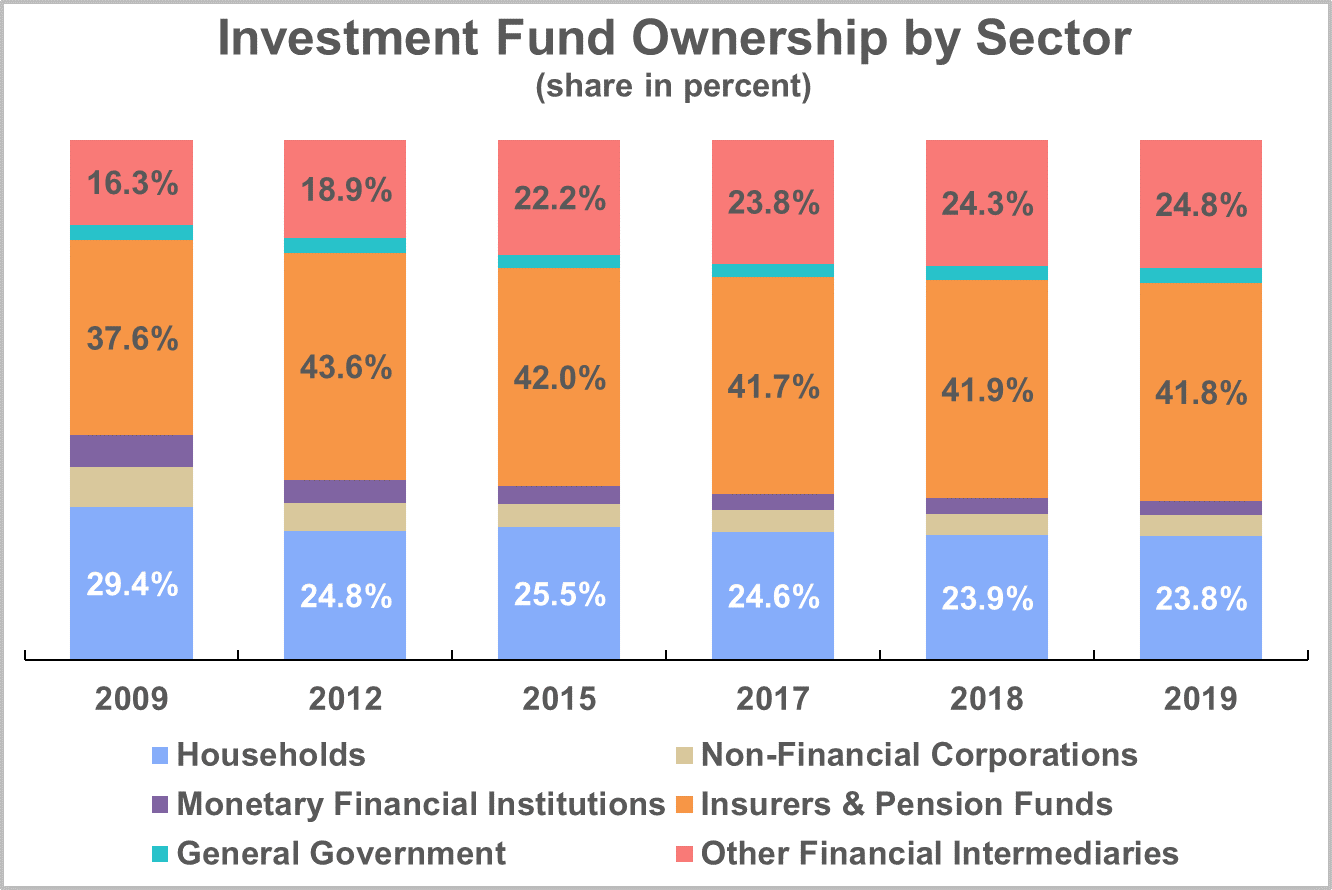

Institutional investors are by far the largest investors in investment funds. Insurers and pension funds accounted for almost 42% of total investment fund ownership at the end of 2019, and this share has increased in recent years. Retail investors, on the other hand, accounted for only 23.8% of fund ownership and their share has declined steadily these past years.

EFAMA's Director General Tanguy van de Werve commented:

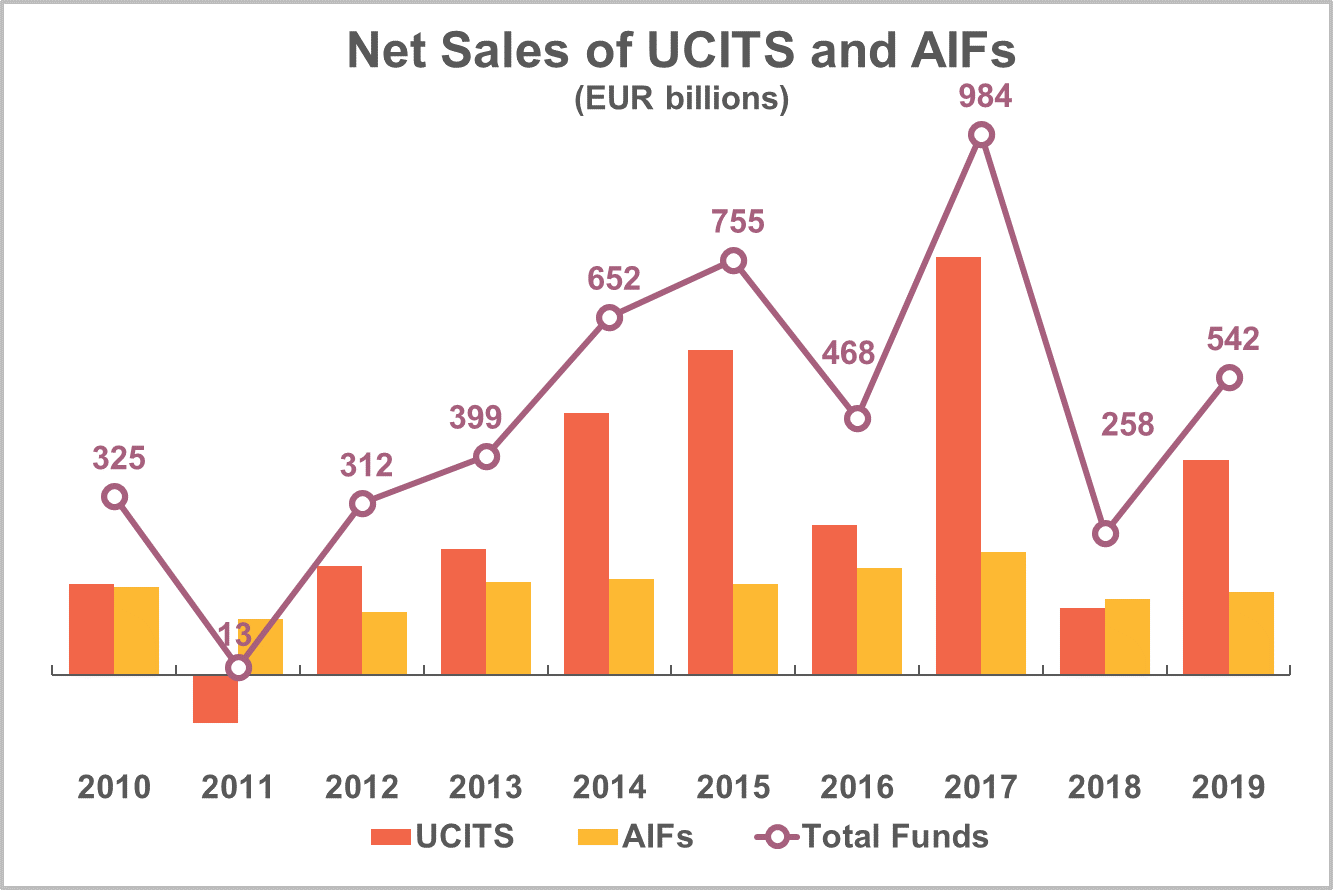

The EFAMA Fact Book has become the definitive touchstone for the most reliable data around UCITS and AIFs, and this new edition is no exception.

The international growth of the cross-border market demonstrates the success of UCITS as a global brand. However, there is no room for complacency. The well-documented flaws of the PRIIPs KID must be remedied as a matter of urgency to avoid contaminating the well-functioning UCITS framework, one of the few European success stories in the financial services space. Members of the High-Level Forum on the CMU seem to share that view.

The persistent low demand for investment funds by retail investors continues to be a cause for concern in view of the low-for-long interest rate environment and the worrying retirement savings gap in most Member States. All efforts should be made to increase retail participation in capital markets, including at national level."

Other key developments in 2019 and over the past decade:

The full Fact Book is available as a hard copy or digitally at https://webshop.efama.org/Pages/Home.aspx. Each purchase comes with a complimentary statistical package in Excel, containing a set of 30 tables with historical time series on net assets and number of UCITS and AIFs at country level.

- ENDS -

For media enquiries, please contact:

EFAMA - info@efama.org

Notes to editors:

About the European Fund and Asset Management Association (EFAMA):

EFAMA, the voice of the European investment management industry, represents 28 member associations and 59 corporate members. At end 2019,total net assets of European investment funds reached EUR 17.8 trillion. These assets were managed by close to 34,200 UCITS (Undertakings for Collective Investments in Transferable Securities) and 29,000 AIFs(Alternative Investment Funds). More information available at www.efama.org.