For immediate release

Brussels, 16 June 2022 - The European Fund and Asset Management Association (EFAMA) has today published its International Quarterly Statistical Release regarding the developments in the worldwide investment fund industry during the first quarter of 2022.

Thomas Tilley, Senior Economist, commented: “Despite the outbreak of the war in Ukraine and new lockdown measures in China, equity and multi-asset funds continued to attract net inflows in Q1 2022, thanks to a very good start of the year. On the other hand, concerns about rising inflation and monetary policy hit bond funds.”

The main developments through the quarter are as follows:

- Decline in net assets of worldwide investment funds

- Net assets of worldwide investment funds decreased by 2.5%. The largest markets, the United States and Europe, registered a net asset decline of 5.5% and 4.5%, respectively.

- Lower but still positive net inflows into long-term funds

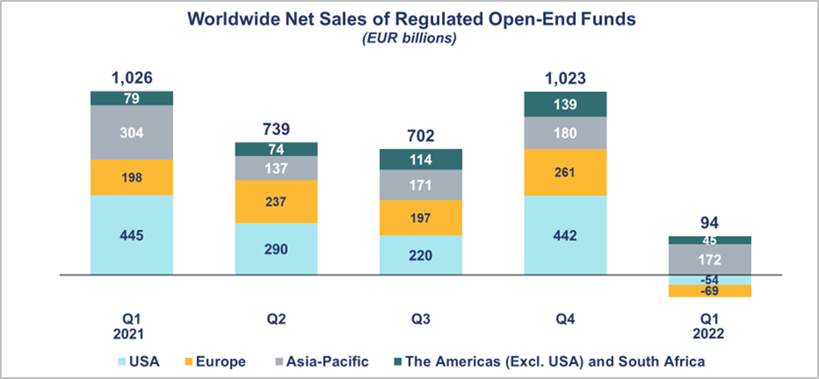

- Long-term funds recorded net inflows of EUR 282 billion, compared to EUR 753 billion in Q4 2021. The Asia-Pacific region accounted for the bulk of the net inflows (EUR 172 billion), whereas Europe and the United States registered net outflows of EUR 69 billion and EUR 54 billion, respectively.

- Equity funds attracted net sales of EUR 185 billion, compared to EUR 271 billion in Q4 2021. This was mainly thanks to strong net sales in the United States (EUR 117 billion) and Japan (EUR 27 billion).

- Multi-asset funds recorded net inflows of EUR 90 billion, down from EUR 168 billion in Q4 2021. Europe accounted for the bulk of net inflows (EUR 77 billion), followed by Canada (EUR 15 billion).

- Bond funds registered net outflows of EUR 50 billion, compared to the inflows of EUR 206 billion in Q4 2021. The United States and Europe recorded net outflows (EUR 39 billion and EUR 38 billion, respectively, whereas China and Brazil saw net inflows (EUR 17 billion each).

- Net outflows from money market funds

- Money market funds registered net outflows of EUR 188 billion, compared to net inflows of EUR 270 billion in Q4 2021.

- Net sales of MMFs turned negative in the United States and Europe to total EUR 144 billion and EUR 124 billion, respectively.

- China, traditionally a strong MMF market, was the exception with net inflows rising to EUR 69 billion.

-- ENDS --