EFAMA published its latest quarterly international statistics, tracking and analysing trends in worldwide regulated open-ended fund assets and flows for Q2 2021.

The main developments can be summarised as follows:

- Net assets of worldwide investment funds continued to grow, pushed up by the overall good performance of global financial markets over the quarter.

- Net assets of worldwide investment funds increased by 4.7%.

- The largest markets, the United States and Europe, grew by 5.4% and 4.4%, respectively.

- Net inflows into long-term funds slowed down after a record-breaking first quarter, mainly as a result of lower net sales in the Unites States and the Asia-Pacific region.

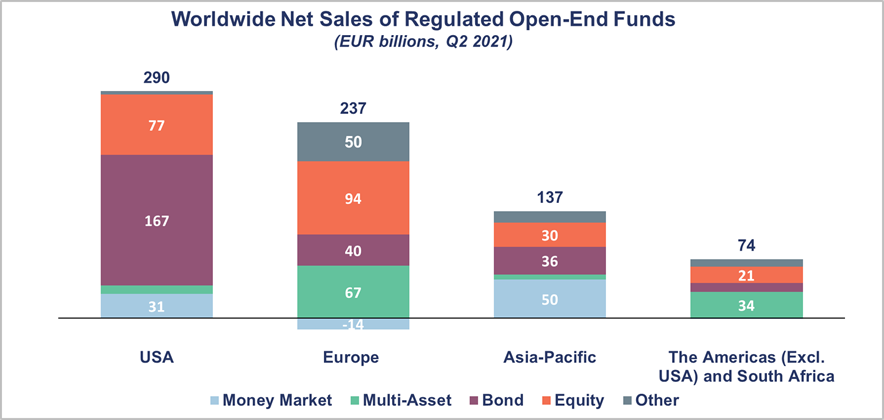

- Worldwide long-term funds recorded net inflows of EUR 673 billion, compared to EUR 807 billion in Q1 2021. The United States accounted for the highest net sales of the quarter (EUR 259 billion), closely followed by Europe (EUR 251 billion).

- Bond funds attracted the largest net sales (EUR 253 billion), mainly due to continued strong demand in the United States (EUR 167 billion).

- Net sales of equity funds remained strong (EUR 222 billion), albeit at a lower level than in Q1 2021 (EUR 293 billion). Europe recorded the strongest net sales (EUR 94 billion), followed by the Unites States (EUR 77 billion) and Japan (EUR 31 billion).

- Multi-asset funds recorded EUR 119 billion of net inflows, down from EUR 189 billion in Q1 2021. Europe accounted for EUR 67 billion in net sales, followed by Canada (EUR 24 billion) and the United States (EUR 11 billion).

- Net sales of money market funds declined sharply, as net inflows went down in China and the United States.

- Worldwide money market funds (MMFs) recorded net inflows of EUR 65 billion, compared to EUR 218 billion in Q1 2021.

- Europe continued to register net outflows of MMFs (EUR 14 billion), albeit at a lower level than in Q1 2021 (EUR 80 billion).

- In the United States, MMFs recorded net inflows (EUR 31 billion), compared to EUR 136 billion in Q1 2021.

- China recorded the highest net sales of MMFs (EUR 53 billion), but net inflows were lower than in Q1 2021 (EUR 144 billion).

Bernard Delbecque, Senior Director for Economics and Research – "Net sales of worldwide investment funds remained at an exceptionally high level, as the demand for equity and bond funds remained robust in an environment where investors maintained their confidence in the prospects of the global economy."