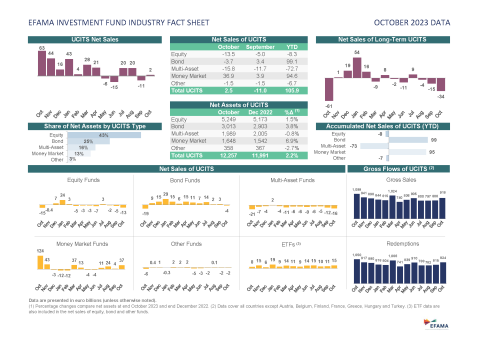

In our latest Monthly Statistical Release, we show the following main developments in October 2023 for the investment fund market:

- UCITS and AIFs saw net inflows of EUR 1 billion, compared to net outflows of EUR 13 billion in September.

- UCITS recorded net inflows of EUR 2 billion, compared to net outflows of EUR 11 billion in September.

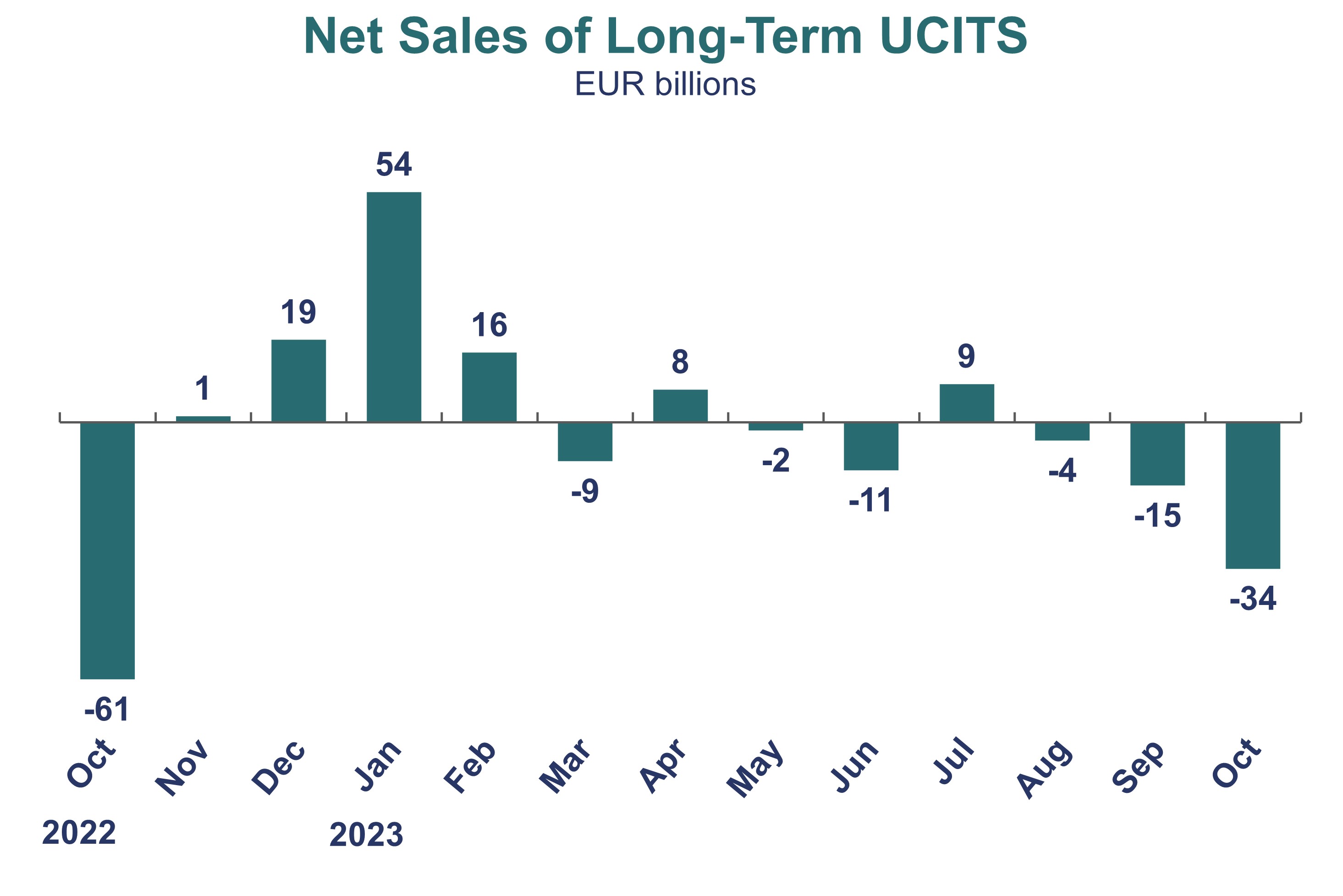

- Long-term UCITS (UCITS excluding money market funds) experienced net outflows of EUR 34 billion, compared to net outflows of EUR 15 billion in September.

- Equity funds recorded net outflows of EUR 13 billion, compared to net outflows of EUR 5 billion in September.

- Bond funds, which consistently attracted inflows every month since November 2022, faced their first monthly outflows of EUR 4 billion.

- Multi-asset funds recorded net outflows of EUR 16 billion, compared to net outflows of EUR 12 billion in September.

- UCITS money market funds recorded net inflows of EUR 37 billion, up from EUR 4 billion in September.

- Long-term UCITS (UCITS excluding money market funds) experienced net outflows of EUR 34 billion, compared to net outflows of EUR 15 billion in September.

- AIFs registered net outflows of EUR 1 billion, compared to net outflows of EUR 2 billion in September.

- Total net assets of UCITS and AIFs decreased by 1.8% in October, reaching EUR 19,397 billion.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented: “Net outflows from long-term UCITS reached levels not seen over the past twelve months, as Hamas’ terrorist attack and Israel’s response generated new uncertainties and concerns for investors.”

- ENDS -

Notes to editors

Chart:

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development

Tel: +32 2 548 26 52

Email: Hayley.McEwen@efama.org