Today, EFAMA has published its latest Monthly Statistical Release for May 2025.

Thomas Tilley, Senior Economist at EFAMA, commented on the May 2025 figures: “Net sales of long-term UCITS rebounded in May as markets recovered from the early April sell-off. Net flows of all main types of long-term UCITS – equity, bond and multi-asset – were positive, whereas MMFs saw net outflows. A general easing of investor concerns over tariffs fueled this recovery.”

The main developments in May can be summarised as follows:

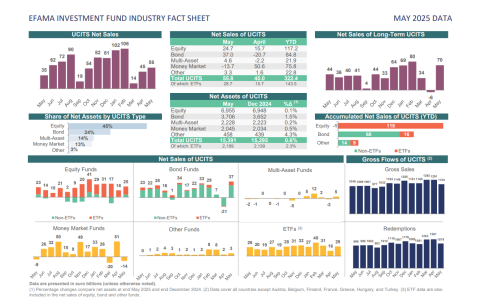

UCITS and AIFs recorded net inflows of EUR 22 billion, down from EUR 56 billion recorded in April 2025.

UCITS recorded net inflows of EUR 56 billion, compared to EUR 45 billion in the previous month.

Long-term UCITS (UCITS excluding money market funds) saw strong net inflows of EUR 70 billion, rebounding from net outflows of EUR 6 billion in April. Of these, ETF UCITS attracted EUR 29 billion in net inflows, up from EUR 16 billion in April.

Equity funds registered net inflows of EUR 25 billion, up from EUR 16 billion in April 2025.

Bond funds recorded net inflows of EUR 37 billion, a sharp reversal from net outflows of EUR 21 billion in April 2025.

Multi-asset funds recorded net inflows of EUR 5 billion, compared to net outflows of EUR 2 billion in April 2025.

UCITS money market funds experienced net outflows of EUR 14 billion, compared to net inflows of EUR 51 billion in April 2025.

AIFs recorded net outflows of EUR 34 billion, compared to net inflows of EUR 11 billion in April 2025. These outflows were largely driven by significant redemptions in the Netherlands.

Total net assets of UCITS and AIFs increased by 2.8% to EUR 23.5 trillion.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development