This article was first published in the 23rd edition of the Fact Book on 24 June 2025.

Given the emphasis on costs and value for money for European investors, we have examined whether lower fees consistently translate into better net performance. Our analysis shows that this is not always the case; less-expensive funds do not necessarily deliver the highest returns, and in some instances, higher-cost funds outperform.

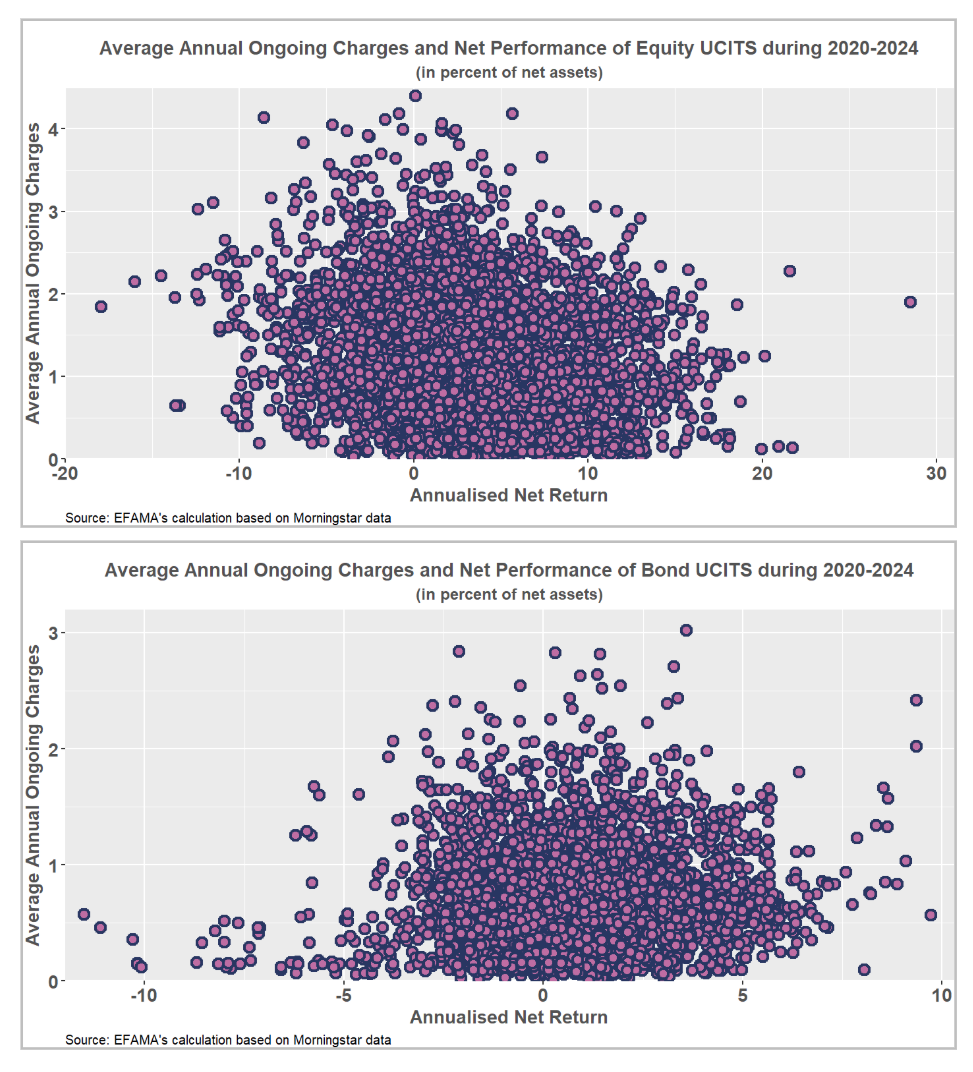

This finding is illustrated in the scatterplots below, which show the average annual ongoing charges and average annualised performance (net of fees) of equity and bond UCITS over the period 2020–2024.1 The charts demonstrate the wide variations in both costs and net performance between UCITS funds. Lower-cost funds do not consistently deliver the highest net returns, while some higher-cost funds achieve superior results. Our analysis also reveals a weak negative correlation between ongoing charges and net performance among equity UCITS and a weak positive correlation in the bond UCITS segment.2

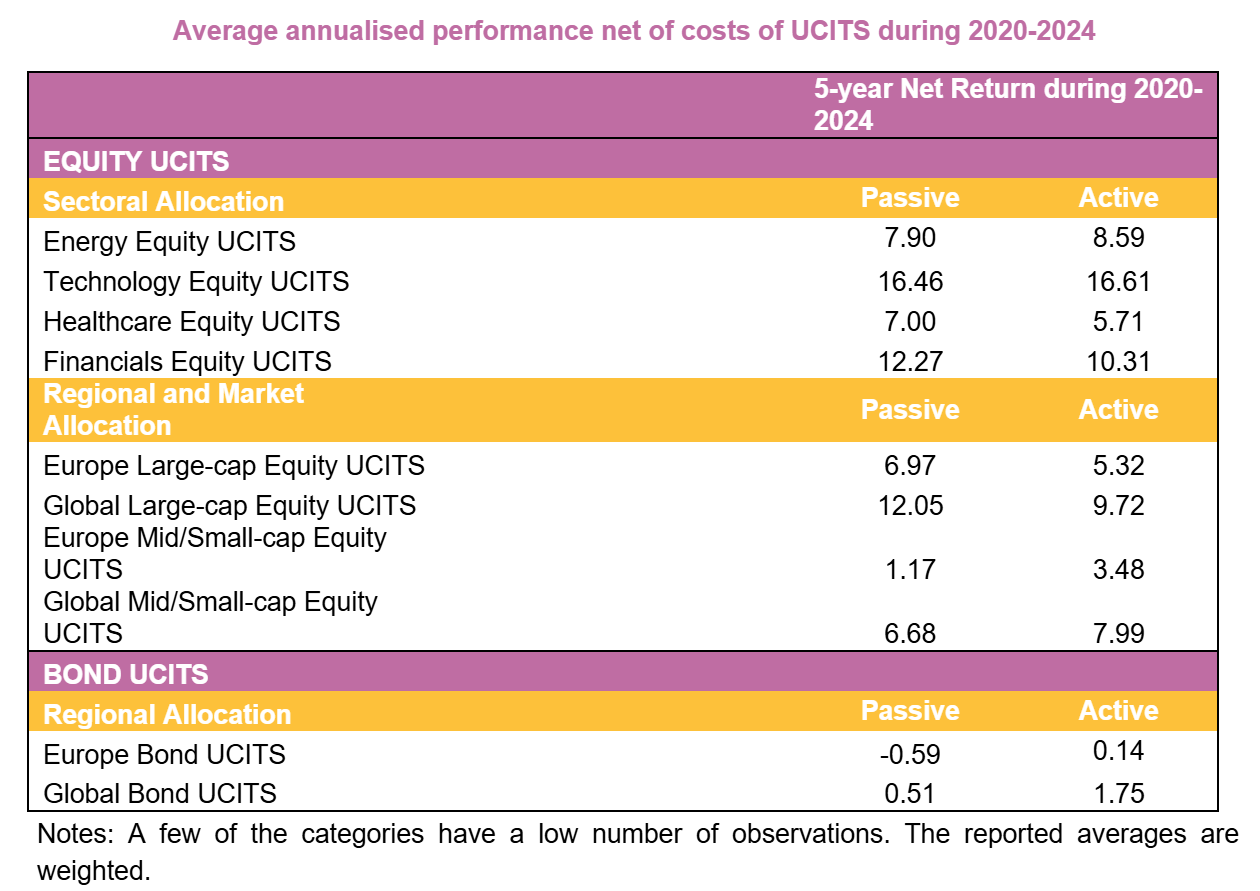

The charts suggest that selecting the right fund is critical, given the broad disparity in net performance across the UCITS universe. The table below reinforces this, by comparing average net performance of different equity and bond fund categories. For example, between 2020 and 2024, Technology Equity UCITS delivered an average net return of 16.61%, while Europe Mid/Small-Cap Equity UCITS returned just 1.17%. This disparity shows that investment strategy has a far more significant impact on returns than fund cost alone. Cost becomes a meaningful decision-driver only when comparing funds with similar investment strategies and objectives.

The table also shows that in some cases, active funds outperform their passive counterparts and vice versa, depending on the segment. In other words, while passive equity funds tend to outperform active funds on average across the full equity UCITS universe, this trend does not hold consistently for all sectors and allocation strategies3. This reinforces that no single fund category consistently delivers superior performance, and that strategy and sector-specific analyses are essential when selecting a fund.

Rather than automatically opting for the lowest-cost fund, investors should focus on understanding the wide range of investment strategies and risk profiles available among UCITS. They should assess which funds best align with their risk tolerance, financial goals, personal convictions, sustainability preferences and investment horizon. Given the complexity of this task, many investors may benefit from seeking advice from qualified financial professionals.

In parallel, it is important for investors to carefully review the key fund documents – particularly the Key Investor Information Document – to fully understand the fund’s objectives, underlying assets and investment style as well as any associated risks or constraints. Adopting such a comprehensive approach helps ensure that the selected fund not only meets cost expectations but also aligns with the investor’s broader needs and long-term priorities.

Notes to Editors

Access the original article here.