“Oliver Wyman’s study ‘Caught on Tape’ provides a perplexing take on Consolidated Tape for Europe. Sure enough, it starts with accurate observations: the high number of trading venues in Europe, the resultant fragmented liquidity, unseen liquidity due to the lack of a consolidated tape, and the fact that leading markets like the US and Canada today benefit from a real time consolidated tape.

Yet, the bulk of the paper goes on to defend the status quo, discourage investment in systems for connectivity and transparency, and worse still alludes to potential financial stability risks that are undefined. This seems rather a backward-looking paper seeking to defend a very static view of the world without regard to the EU’s aspirations both toward completing a Capital Markets Union and remaining an attractive investment destination for global investors.

We have argued and continue to argue that a real-time tape is essential to enhancing retail investors' confidence in EU capital markets, and from an asset management perspective, providing a powerful tool for asset managers to improve basic functions like liquidity risk management, trading strategy and best execution.”

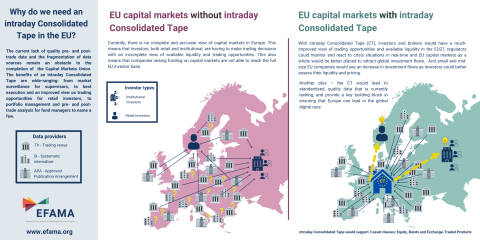

Infographic on real-time Consolidated Tape: Visual | Why do we need a real-time Consolidated Tape in the EU? | EFAMA