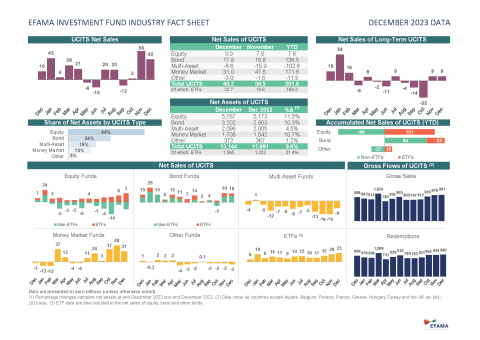

In our latest Monthly Statistical Release, we show the following main developments in December 2023 for the European investment fund market. A first overview and analysis of the full year 2023 is also included.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented on the 2023 results: “In 2023, the high level of interest rates and the more gradual tightening stance spurred significant net inflows into money market funds and bond funds. Concurrently, net sales of actively managed equity funds experienced a lack of investor demand, whereas ETFs took the forefront in driving net sales within the equity fund landscape”.

Thomas Tilley, Senior Economist at EFAMA, commented on the December 2023 figures: “Net sales of bond UCITS remained at a high level in December as some investors were already anticipating interest rate cuts in 2024.”

The main developments in 2023 can be summarised as follows:

In 2023, UCITS and AIFs attracted net inflows of EUR 304bn, marking a significant reversal from the net outflows of EUR 273bn observed in 2022. In parallel, the net assets of European investment funds increased, experiencing a growth rate of 8% and surpassing the EUR 20 trillion threshold once again.

UCITS registered net sales of EUR 202bn in 2023, compared to negative net sales of EUR 167bn in 2022.

- Equity fund net sales rebounded into positive territory, driven by substantial net inflows in equity ETFs. Following net outflows in 2022 totalling EUR 67bn, attributed to decelerating economic growth and significant monetary policy tightening, net sales saw a recovery in 2023 amounting to EUR 8bn, fueled by a vigorous upsurge in the stock markets. However, investors favoured ETFs for stock market investments, with equity ETFs drawing in EUR 101bn in net new money during 2023, while non-ETFs experienced net outflows of EUR 94bn.

- Bond funds experienced a recovery as interest rates stabilised. In 2022, bond UCITS suffered net outflows of EUR 127bn due to sharp interest rate increases. However, in 2023, the apparent halt to central bank rate hikes and anticipation of potential rate cuts in 2024 led to a reversal in net sales, resulting in net inflows of EUR 137bn. Bond ETFs attracted EUR 53bn, while non-ETFs inflows reached EUR 84bn.

- Multi-assets funds fell out of favour, marking the first yearly net outflows since 2008. Net outflows from multi-assets UCITS totalled EUR 103 bn, compared to net inflows of EUR 14bn in 2022. Multi-asset UCITS was the only long-term fund type to attract net inflows in 2022, this completely reversed in 2023 as investors shifted towards ETFs and fixed-income funds.

- Money market funds (MMFs) had an excellent year. MMFs attracted EUR 172bn of net new money during 2023, the second highest of the decade, second only to pandemic year 2020. These substantial net inflows were largely driven by the inverted yield curve prevailing for much of 2023, offering higher yields for funds primarily investing in short-term products like MMFs.

- 2023 was a record-breaking year for ETFs. Net inflows reached a new record of EUR 169bn, surpassing both the EUR 86bn seen in 2022 and the previous record of EUR 161bn in 2021. ETFs continued to gain popularity due to their low cost and trading flexibility attributes.

Net sales of AIFs returned to positive territory. Net inflows into AIFs reached EUR 102bn, compared to net outflows of EUR 105bn in 2022. The negative net sales in 2022 could be primarily attributed to a trend among some Dutch and Danish pension funds shifting their AIF wrappers to segregated mandates due to the new IFR/IFD prudential rules. However, this shift appeared to slow down in 2023, resulting in overall net AIF inflows. Among all AIF types, other AIFs attracted the highest net sales in 2023, amounting to EUR 92 billion, compared to EUR 84 billion in 2022.

Analysing the data for December 2023 in particular, EFAMA highlighted the following:

- Net sales of UCITS and AIFs totalled EUR 98bn, up from EUR 63bn in November.

- UCITS recorded net inflows of EUR 40bn, compared to EUR 56bn in November.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 9bn of net sales, similar to EUR 9bn in November.

- Equity funds registered net inflows of EUR 3bn, compared to EUR 8bn in November.

- Net sales of bond funds amounted to EUR 18bn, slightly down compared to EUR 19bn in November.

- Multi-asset funds recorded net outflows of EUR 9bn, compared to net outflows of EUR 16bn in November.

- UCITS money market funds experienced net inflows of EUR 31bn, compared to net inflows of EUR 48bn in November.

- Long-term UCITS (UCITS excluding money market funds) recorded EUR 9bn of net sales, similar to EUR 9bn in November.

- AIFs recorded net inflows of EUR 58bn, compared to net inflows of EUR 7bn in November. These sizeable December net inflows were due to the set-up of a large new other AIF fund in Liechtenstein.

- Total net assets of UCITS and AIFs increased by 2.7% to EUR 20,631bn.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development

Tel: +32 2 548 26 52

Email: Hayley.McEwen@efama.org