A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues. For equities and ETFs, this will mean delivery in the second range (1000 millisecond). For fixed income the speed can be slower (in minutes) given the specific dynamics of price-driven markets which also need to take into account the applicable waivers and deferrals.”

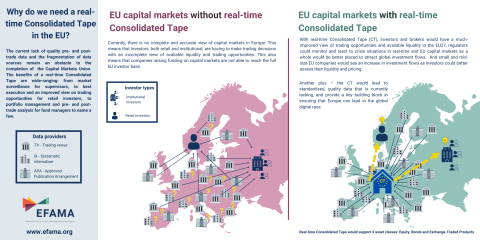

Global investment flows into Europe would increase as a result of a real-time tape, as would European retail investor confidence with the improved availability of price and liquidity data across EU venues. It would also improve small and mid-cap firms’ access to capital market funding by providing better visibility into their liquidity profiles. Asset managers (buy-side firms) would stand to benefit from the real-time tape with a number of key asset management activities, as described below, relying on comprehensive and real-time trade data.

Level Playing Field

A real-time consolidated tape is also a precondition for truly integrated markets where investors, irrespective of size or location, are able to access the same comprehensive dataset to inform trading and execution decisions. Currently, comprehensive and accurate market data is only attainable for the largest asset managers who replicate what the CT would deliver through in-house consolidation. This is out of reach therefore for the large majority of institutional investors and, all retail investors, creating an unlevel playing field among market participants.

From a market-wide perspective, an affordable CT should deliver greater transparency and actionable data, to all types of investors, while respecting deferral arrangements for applicable assets. The CT should be designed more with that end objective in mind, and less with a view to accommodating existing business models of stock exchanges. Today, the revenue generated by exchanges is based on data delivered at a very low latency. The consolidated tape would not disrupt these revenue streams, as the proposed speed on an equity CT is at a much slower seconds speed as compared to the millisecond speed prevalent on exchanges’ feeds (see Annex II) Looking ahead to coming waves of digital transformation for the asset management industry (DLT as an underlying technology and disintermediation being the front-runners), a real-time CT for Europe is a bare minimum to access the next phase of development and innovation.

The use-cases associated with a real-time CT today are broad, though in the examples below we focus on the buy-side (asset management) use-cases. The use-cases rely on a real-time consolidated tape (delivered in seconds speed), supporting different asset classes including: equities, equity-like (Exchange Trade Products) and fixed-income. The data on the CT should also cover both pre and post-trade data.

Latency

The speed of delivery is critical. The exclusive use of a consolidated tape providing 15-minute delayed data, as suggested by some stakeholders, would cause an estimated total annual value distortion of EUR 8 billion on EU equities held by Euro-area funds based on 2020 ECB data. [1] This EUR 8 billion figure represents the direct cost to end investors of asset managers making trading decisions based on 15-minute delayed data. (See Annex I)

A similar analysis, tying trading decisions to 15-minute old data, can be performed in periods of extreme volatility like that experienced during March-April 2020. Using the same two stocks used for the annual analysis, 15-minute data can cause market impact (increase or decrease in price) as per the chart below. The difference in reported price can account for losses of up to EUR 8 million on a single stock, see SAP table below. Similarly for BP, a 15 minute delay could account for a difference in market value upwards of GPB 6 million.

[1] This is based on ECB data on EU Equities held by Euro-area funds, and the price movements of two shares BP and SAP over two days, showing movements of 0.3% and 0.4% respectively over a 15 minute period (selected as representative equities) See annex I