The European Fund and Asset Management Association (EFAMA), has today published its latest International Statistical Release describing the trends in worldwide investment fund industry in the second quarter of 2020*.

Worldwide regulated open-ended fund assets increased by 9.8 percent to EUR 51.7 trillion in the second quarter of 2020. Worldwide net cash flow to all funds amounted to EUR 818 billion, compared to EUR 617 billion in the first quarter of 2020.

Bernard Delbecque, Senior Director for Economics and Research commented: "The large sums invested in money market funds during the second quarter signal that investors around the world remained cautious about the COVID-19 risks".

The main developments in the second quarter of 2020 can be summarized as follows:

- Solid increase in net assets of worldwide investment funds - Net assets of worldwide investment funds increased by 9.8 percent in Q2 2020. The largest markets, the United States and Europe, registered a net asset growth of 14.4% and 9.2%, respectively. The strong recovery in global financial markets in the second quarter explain the upturn in net fund assets.

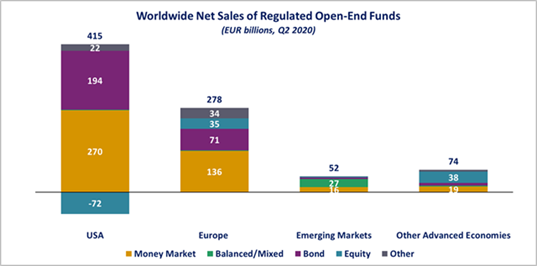

- Strong rebound in net sales of long-term funds - Worldwide long-term funds recorded net inflows of EUR 377 billion in Q2 2020, compared to net outflows of EUR 213 billion in Q1 2020. The United States and Europe accounted for the bulk of net sales (EUR 146 billion and EUR 141 billion, respectively). Other advanced economies and emerging markets recorded net inflows into long-term funds of EUR 55 billion and EUR 35 billion, respectively. Bond funds attracted the vast majority of net sales (EUR 279 billion), mostly in the United States (EUR 194 billion) and Europe (EUR 71 billion). Net sales of equity funds (EUR 4 billion) turned again positive, thanks to sustained net sales in Japan (EUR 36 billion) and a strong rebound in Europe (EUR 35 billion), whereas the United States suffered from a rise in net outflows to EUR 72 billion. Net sales of long-term funds, mainly bond funds, bounced back as investors reacted positively to the full range of monetary and fiscal measures adopted across the globe.

Net sales of money market funds remained high - Worldwide money market funds attracted EUR 441 billion in net new money in Q2 2020, compared to EUR 829 billion in the first quarter. The largest part of net sales was recorded in the United States (EUR 270 billion) and Europe (EUR 136 billion). Investors continued to invest substantial amounts in money market funds in the second quarter, in response to persistent uncertainty about the evolution of the COVID-19 pandemic.

For media enquiries, please contact:

Hume Brophy:

Kerri Anne Rice kerrianne.rice@humebrophy.com

Paul Andrieu paul.andrieu@humebrophy.com

Notes to editors:

About the report

The report for the second quarter of 2020 contains statistics from the following 47 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, Trinidad & Tobago, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Rep. of Korea, New Zealand, Pakistan, Philippines, Taiwan, South Africa.

About the European Fund and Asset Management Association (EFAMA):

EFAMA, the voice of the European investment management industry, represents 28 Member Associations, 60 Corporate Members and 23 Associate Members. At end Q2 2020, total net assets of European investment funds reached EUR 17.1 trillion. These assets were managed by almost 34,200 UCITS (Undertakings for Collective Investments in Transferable Securities) and more than 29,100 AIFs (Alternative Investment Funds). More information is available at www.efama.org.