|

The European Fund and Asset Management Association (EFAMA) has today published its latest quarterly international statistics, tracking and analysing trends in worldwide regulated open-ended fund assets and flows for Q3 2020.

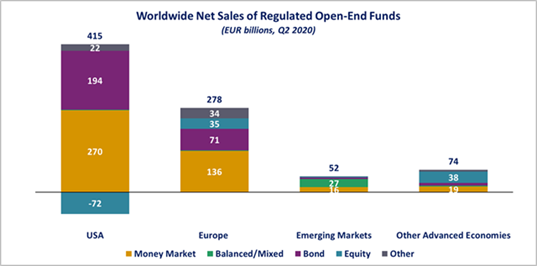

Bernard Delbecque, Senior Director for Economics and Research commented: Despite strong net outflows from equity funds in the United States, net sales of worldwide long-term funds remained very high in Q3 2020. A trend supported by continued demand in Europe and other advanced economies, the sharp increase in net sales of multi-asset funds in China and the sustained demand for bond funds in the United States.

The main developments in Q3 2020 can be summarised as follows:

Growth in worldwide net assets of investment funds

|

|

|

|

|

|

-- ENDS -- |

|

Please see the

For media enquiries, please contact:

Hume Brophy Brandon Bhatti Brandon.bhatti@humebrophy.com Paul Andrieu paul.andrieu@humebrophy.com EFAMA

Notes to editors:

About the report The report for the second quarter of 2020 contains statistics from the following 47 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, Trinidad & Tobago, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Rep. of Korea, New Zealand, Pakistan, Philippines, Taiwan, South Africa.

About the European Fund and Asset Management Association (EFAMA): EFAMA, the voice of the European investment management industry, represents 28 Member Associations, 60 Corporate Members and 24 Associate Members. At end Q3 2020, total net assets of European investment funds reached EUR 17.6 trillion. These assets were managed by more than 34,200 UCITS (Undertakings for Collective Investments in Transferable Securities) and almost 29,400 AIFs (Alternative Investment Funds). At the end of Q2 2020, assets managed by European asset managers as investment funds and discretionary mandates amounted to an estimated EUR 24.9 trillion. More information is available at www.efama.org. |

|

Follow EFAMA on Twitter @EFAMANews or LinkedIn @EFAMA for latest updates |