EFAMA has today published its European Quarterly Statistical Release for Q1 of 2023.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented: “The positive results for the first quarter reflects the strong January net sales of long-term UCITS, which sharply declined thereafter amid rising concerns regarding the economic outlook and the collapse of Silicon Valley Bank.”

The main developments through the quarter are as follows:

-

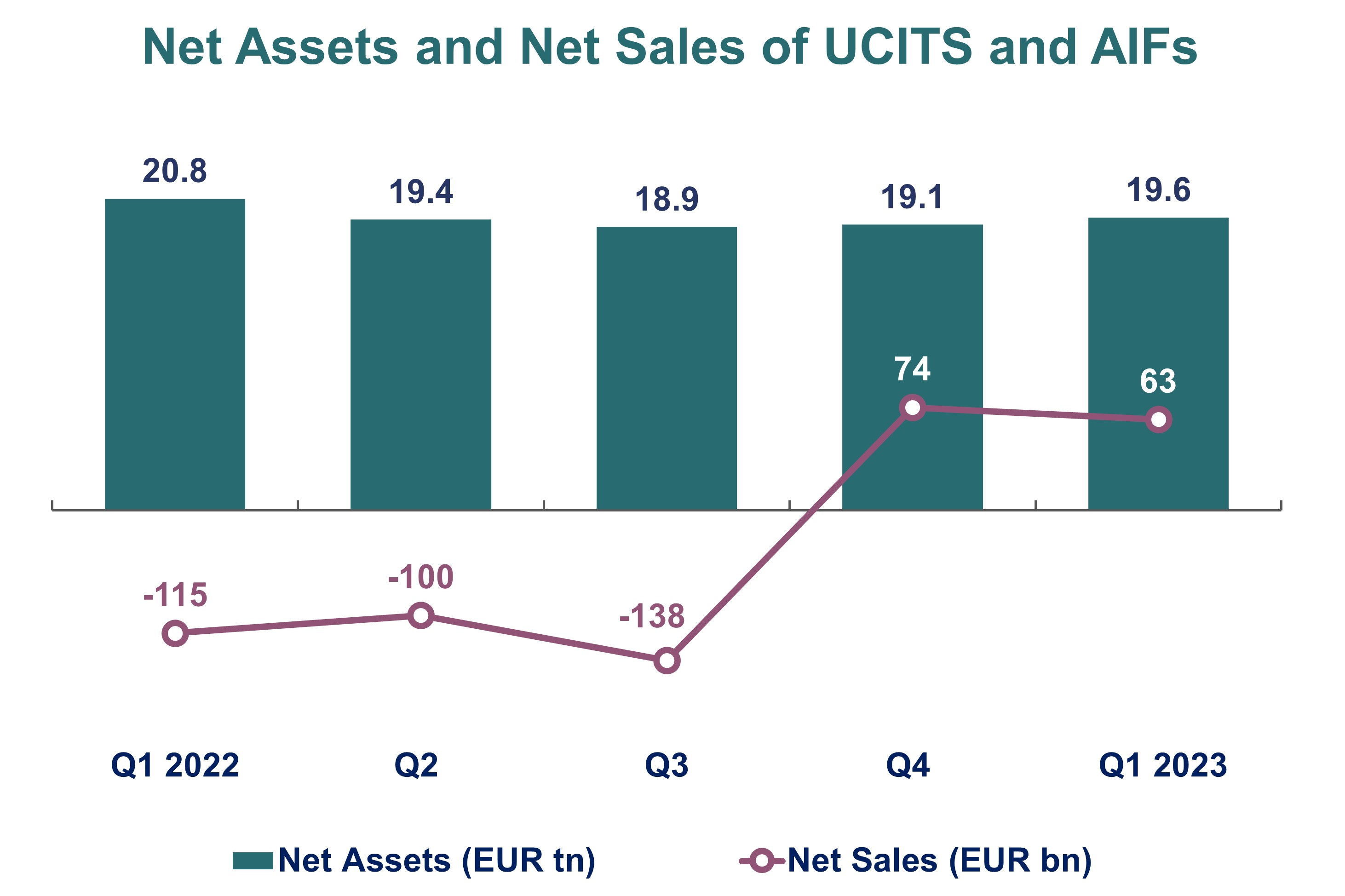

The net assets of UCITS and AIFs increased by 2.5% to EUR 19.57 trillion.

-

Net sales of UCITS slowed down from EUR 128 billion in Q4 2022 to EUR 76 billion, due to much lower net inflows into money market funds (EUR 13 billion compared to EUR 164 billion).

-

Demand for equity and bond UCITS strengthened after three consecutive quarters of negative net sales.

-

AIFs experienced lower net outflows: EUR 13 billion compared to EUR 54 billion in Q4 2022.

-

Net sales of SFDR Article 9 UCITS totaled EUR 4 billion, compared to EUR 7 billion in Q4 2022, whereas Article 8 UCITS suffered a decline in net sales from EUR 128 billion to EUR 10 billion.

-

Net acquisitions of investment funds by European households picked up again to EUR 24 billion in Q4 2022.

Notes to editors

About the EFAMA Quarterly Statistical Release:

The release is published by EFAMA every quarter and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom. It also includes a section providing information on the owners of investment funds in Europe and their net purchases of funds.

For further information, please contact:

EFAMA Secretariat

Tel: +32 2 513 39 69

Email: info@efama.org