Today, EFAMA has published its latest Monthly Statistical Release for November 2025.

Ella Vacic, Junior Data Analyst at EFAMA, commented on the November 2025 figures: “Despite a gentle slowdown in November, net inflows remained positive across all UCITS fund categories. Multi-asset funds outsold equity-only funds, but bond funds remained the largest beneficiary as investors maintain a cautious approach.”

The main developments in November can be summarised as follows:

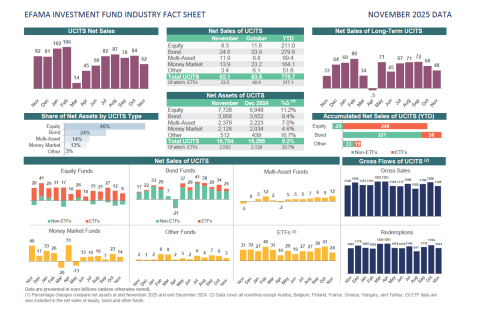

UCITS and AIFs recorded net inflows of EUR 67 billion, down from EUR 89 billion recorded in October 2025.

UCITS recorded net inflows of EUR 62 billion, down from EUR 84 billion in the previous month.

Long-term UCITS (UCITS excluding money market funds) saw net inflows of EUR 48 billion, down from EUR 60 billion in October. Of these, ETF UCITS attracted EUR 24 billion in net inflows, down from EUR 41 billion in the previous month.

Equity funds registered net inflows of EUR 8 billion, down from EUR 12 billion in October 2025.

Bond funds recorded net inflows of EUR 25 billion, down from EUR 34 billion in October 2025.

Multi-asset funds recorded net inflows of EUR 12 billion, up from EUR 9 billion in October 2025.

UCITS money market funds saw net inflows of EUR 14 billion, down from EUR 23 billion in October 2025.

AIFs recorded net inflows of EUR 4.5 billion, slightly down from EUR 5 billion in October 2025.

Total net assets of UCITS and AIFs increased by 0.3% to EUR 25.2 trillion.

-ENDS-

Notes to editors

About the Monthly EFAMA Investment Fund Industry Fact Sheet:

The Fact Sheet is published by EFAMA monthly and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom.

For further information, please contact:

Hayley McEwen

Head of communication & membership development