EFAMA has today published its European Quarterly Statistical Release for Q2 of 2023.

Bernard Delbecque, Senior Director for Economics and Research at EFAMA, commented: “Net sales of UCITS turned negative in Q2 2023, reflecting greater investor caution about the equities market in the midst of growing uncertainty about the resilience of the global economy to the current level of interest rates.”

The main developments through the quarter are as follows:

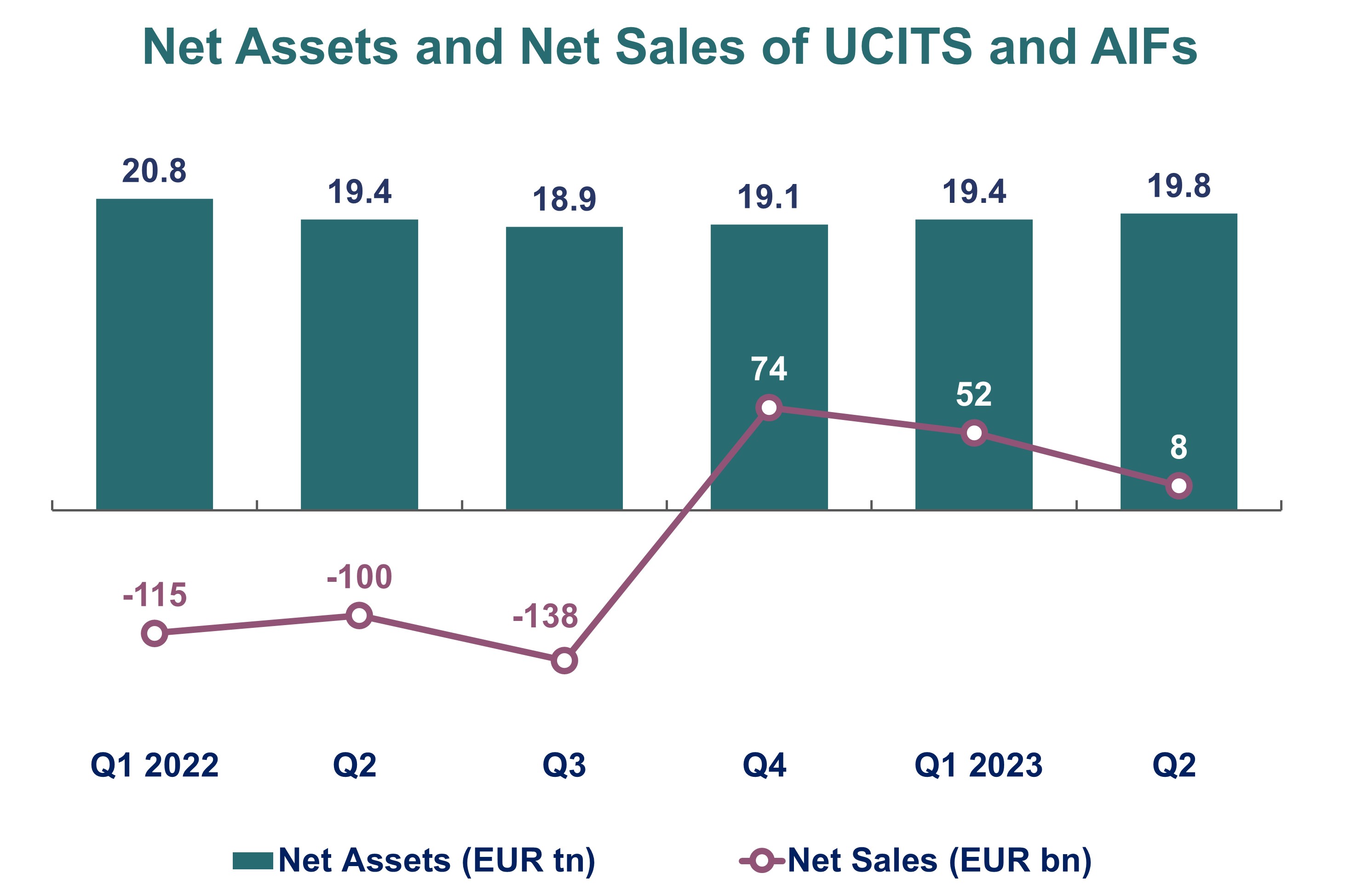

- Net assets of UCITS and AIFs increased by 2% to EUR 19.8 trillion.

- UCITS registered net outflows of EUR 1 billion, compared to net inflows of EUR 76 billion in Q1.

- Equity and multi-assets funds recorded net outflows of EUR 13 billion and EUR 21 billion, respectively

- Bond funds continued to record net inflows, albeit less than Q1, i.e., EUR 35 billion compared to EUR 51 billion

- MMFs recorded net inflows totaling EUR 5 billion

- Other funds recorded net outflows of EUR 7 billion

- AIFs experienced net inflows of EUR 9 billion, compared to net outflows of EUR 24 billion in Q1

- Equity and multi-assets funds also recorded net outflows: EUR 20 billion and EUR 13 billion, respectively

- Bond funds recorded net inflows of EUR 8 billion, compared to net outflows of EUR 25 billion in Q1

- MMFs recorded net inflows totaling EUR 3 billion

- Real estate funds registered net inflows of EUR 3 billion

- Other funds recorded net inflows of EUR 27 billion

- SFDR Article 9 funds registered net inflows for the 9th consecutive quarter.

- European households’ net acquisition of investment funds remained positive in Q1, totaling EUR 31 billion.

-ENDS-

Notes to editors

About the EFAMA Quarterly Statistical Release:

The release is published by EFAMA every quarter and presents net sales and net assets data for UCITS and AIFs for 29 European countries: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and United Kingdom. It also includes a section providing information on the owners of investment funds in Europe and their net purchases of funds.

For further information, please contact:

Hayley McEwen

Head of Communication & Membership Development

Tel: +32 2 548 26 52

Email: Hayley.McEwen@efama.org