EFAMA has today published its International Quarterly Statistical Release regarding the developments in the worldwide investment fund industry during the second quarter of 2022.

Bernard Delbecque, Senior Director for Economics and Research, commented “Interest rate increases and fears of an economic slowdown led to large net outflows from long-term investment funds in the United States and Europe in the second quarter of 2022. Conversely, except for multi-asset funds, all fund types in China recorded net inflows, with bond and money market funds doing particularly well.”

The main developments through Q2 2022 are as follows:

- Decrease in the net assets of worldwide investment funds

- Net assets of worldwide investment funds decreased by 5.5%.

- Net assets in the largest markets, the United States and Europe fell by 12% and 6.9%, respectively. China was the only major market that registered net asset growth (7%).

Worldwide net fund assets declined further in Q2 2022, as rising inflation and the continued war in Ukraine negatively impacted financial markets.

- Net sales of long-term funds turned negative

- Worldwide long-term funds recorded net outflows of EUR 172 billion, compared to net inflows of EUR 281 billion in Q1 2022. The Asia-Pacific region was the only region that recorded net inflows (EUR 139 billion), thanks to solid net inflows in China (EUR 120 billion). The United States and Europe registered net outflows of EUR 187 billion and EUR 89 billion, respectively.

- Bond funds registered large net outflows (EUR 116 billion), mainly due to net outflows in the United States (EUR 119 billion).

- Net sales of equity funds turned negative (EUR 61 billion), compared to net inflows of EUR 184 billion in Q1 2022. Europe accounted for the bulk of net outflows (EUR 59 billion).

- Multi-asset fund flows also turned negative (EUR 54 billion) compared to net inflows of EUR 90 billion in Q1 2022. China (EUR 21 billion), the United States (EUR 19 billion), and Canada (EUR 14 billion) registered net outflows, whereas Europe accounted for EUR 11 billion in net inflows.

Net sales of long-term funds turned negative for the first time since Q1 2020 as investors were mainly deterred by the prospect of a more restrictive monetary policy.

- Net sales of money market funds recovered

- Worldwide money market funds (MMFs) recorded net inflows of EUR 34 billion, compared to net outflows of EUR 189 billion in Q1 2022.

- Europe continued to register net outflows of MMFs (EUR 18 billion), but at a lower level than in Q1 2022 (EUR 124 billion).

- In the United States, MMFs also still recorded net outflows (EUR 37 billion), but also lower than in Q1 2022 (EUR 146 billion).

- China recorded strong net inflows of MMFs (EUR 76 billion) in Q2 2022, with net sales slightly higher than in Q1 2022 (EUR 69 billion).

Net sales of worldwide MMFs recovered in Q2 2022 thanks to solid net inflows in China and lower net outflows in Europe and the United States.

%20picture%20for%20the%20press%20release.png)

-- ENDS --

About the EFAMA Quarterly International Statistical Releases:

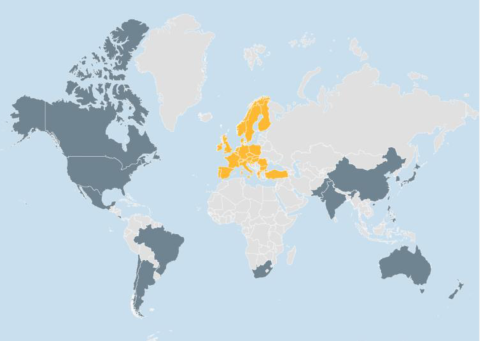

The EFAMA Worldwide Investment Fund Assets and Flows quarterly release focuses on net assets and net sales of worldwide investment funds, whilst also presenting a commentary on the trends in the industry during the quarter. The report contains data on the largest domiciles of investment funds around the globe and the position of Europe in the worldwide context. The report contains statistics from the following 46 countries: Argentina, Brazil, Canada, Chile, Costa Rica, Mexico, United States, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lichtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, Australia, China, India, Japan, Republic of Korea, New Zealand, Pakistan, Philippines, Taiwan, and South Africa.