EFAMA firmly supports the Commission’s proposed amend of the ELTIF Regulation, in line with its recently revamped “new” CMU.

European Long-Term Investment Fund (ELTIF)

The European Long-Term Investment Fund (ELTIF) is an investment vehicle designed for investors who want to make long-term investments into companies and projects. The current ELTIF regime allows all types of investors to invest long-term in European non-listed companies and in long-term assets such as real estate and infrastructure projects. Asset managers have a primary role to play in maximising the pooling and diversification of capital and managing collective investment schemes.

EFAMA believes that the current ELTIF Regulation needs to be amended, to fully unlock its potential and become a product of choice for investors. We advocate for an “evergreen” product with the recalibration of the regulation’s asset eligibility requirements, minimum investment amounts and the establishment of adequate tax incentives.

EFAMA's response to the EC's public consultation on the review of ELTIF Regulatory Framework

EFAMA’s comments on ESMA’s CP on Draft regulatory technical standards under Article 25 of ELTIF Regulation

EFAMA response to Green Paper on Retail Financial Services

EFAMA welcomes the opportunity to respond to the European Commission’s Green Paper on retail financial services. Widening the opportunities for European citizens to save and invest will facilitate better outcomes both for savers and the wider European economy.

EFAMA fully shares the goals of a Single Market for retail financial services in the EU, i.e.:

1. Promoting an EU-wide market in retail financial services that can facilitate cross-border business and consumer choice.

ESMA Consultation Paper on Draft Regulatory Technical Standards under the Revised ELTIF Regulation

EFAMA responds to ESMA's Consultation Paper - From only 20 ELTIFs at the start of the review of the ELTIF Regulation in late 2021 to 95 as of August 2023, the launch of ELTIF products has significantly increased over the last three years, with further market growth expected in the years to come.

We strongly encourage ESMA to uphold the positive momentum of reforms initiated at Level 1 and guarantee that the requirements established by the draft RTS are conducive to the ongoing success of the ELTIF product.

The newly revised ELTIF regime will only be successful if ESMA maintains sufficient flexibility

The European Securities and Markets Authority (ESMA) is currently finalising technical rules on the functioning of European Long-Term Investment Funds (ELTIFs). It will be crucial to the future success of ELTIFs that these rules are supportive and not limiting.

New ELTIF 2.0 regulation will facilitate retail investor access to long-term investment opportunities in Europe

Today, the European Parliament voted in favor of amending the European Long-Term Investment Funds (ELTIF) Regulation, following the European Commission’s proposal in November 2021. The revamped regime now has the potential to become an attractive “go-to” fund structure for long-term investments, with particularly beneficial improvements for retail investors.

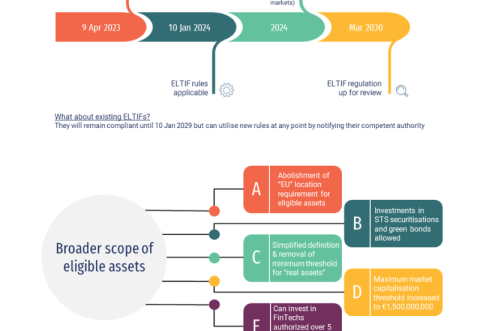

Infographic | ELTIF

The European long-term investment fund (ELTIF) is a regulated pan-European label for alternative

investment funds (AIFs). ELTIFs may invest in a variety of assets and may be marketed to retail

and professional investors under the harmonised passporting regime of the ELTIF Regulation.

ELTIFs are regulated by the ELTIF Regulation (EU) 2023/606 amending (EU) 2015/760 on

European long-term investment funds. The ELTIF Regulation is applicable as of 10 January 2024.

FAQ: ELTIF Regulation 2.0

The new European Long-Term Investment Fund (ELTIF) Regulation became applicable on 10 January 2024. Going forward, fund managers will have greater flexibility to make ELTIFs more attractive to end investors, particularly on the retail side, unlocking their potential as a source of financing for the European real economy. To support the success of ‘ELTIF 2.0’, EFAMA and Arendt have published a ‘Frequently Asked Questions’ brochure, which covers the most burning questions asset managers may have regarding the new regime.

ELTIF 2.0 - European Long-Term Investment Funds

In the 9th issue of our “3 Questions 2” (3Q2) series, we spoke with Stuart Corrigall, Chair of the EFAMA Fund Regulation Standing Committee and Managing Director at BlackRock, on ELTIF 2.0.

He answers the following questions:

1: What is an ELTIF, and why did the current ELTIF regime need to be revised?

2: What are the major changes the review process introduced?

3: In light of those changes, is ELTIF 2.0 going to be successful?