The ongoing review of MiFIDII/MiFIR is an important moment for the future success of the Capital Markets Union project. The European Council adopted their position at the end of last year and the European Parliament is currently debating these future rules, with the expectation of a draft report by the end of the month.

Asset Management in Europe

EFAMA's 17th edition of its ‘Asset Management in Europe’ report provides an in-depth analysis of recent trends in the European asset management industry.

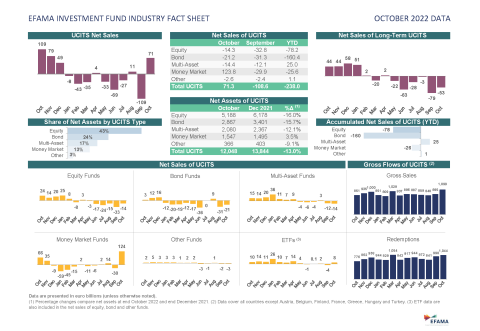

Data on many different facets of the industry are covered, including:

- Total assets under management in Europe, covering investment funds and discretionary mandates

- The role of asset managers in Society and the Economy, including serving investors' needs and engaging with investee companies.

- Industry clients: at both European and country levels, including domestic and foreign clients.

- Asset allocation in Europe of investment funds and mandates, including ESG assets

- Industry organisation, such as market concentration, industry profitability and employment