This is a timely and necessary review to which we hope to contribute in a constructive manner. As already recognised in the consultation paper and in the MiFID Quick Fix proposal, RTS 27 and RTS 28 currently fall short of the objective of providing valuable and comparable datasets for investment managers and the investing public. We appreciate the present effort to revise reporting requirements to produce more meaningful reports.

Capital markets

Investment managers, acting on behalf of their retail and institutional clients, are among the largest investors in financial markets. They represent a key component of the market’s “buy-side” segment.

In representing the interests of its members on wholesale capital market issues, EFAMA advocates for fair, deep, liquid, and transparent capital markets, supported by properly regulated and supervised market infrastructure.

EFAMA’s response to ESMA’s Review of the MiFID II framework on best execution reports

Industry Approach to CSDR Settlement Discipline Regime

The Joint Associations1 welcome clarification from ESMA that national competent authorities are expected not to prioritise supervisory actions in relation to the application of the CSDR buy-in regime.2

Joint Statement on EU Commission proposal for revised Market in Financial Instrument Regulation (MiFIR)

We see great value in the creation of a consolidated tape to support Europe’s capital markets. However, we qualify that statement with a reminder that the framework for a successful consolidated tape should

i) address the known market failure around market data costs,

Statement on the release of the Oliver Wyman study ‘Caught on Tape’

“Oliver Wyman’s study ‘Caught on Tape’ provides a perplexing take on Consolidated Tape for Europe. Sure enough, it starts with accurate observations: the high number of trading venues in Europe, the resultant fragmented liquidity, unseen liquidity due to the lack of a consolidated tape, and the fact that leading markets like the US and Canada today benefit from a real time consolidated tape.

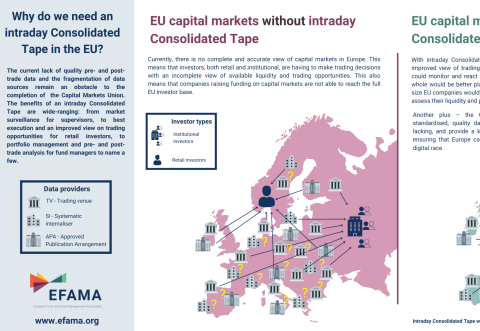

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

UK clearing house equivalence - request from nine trade associations

Nine associations (AFME, AIMA, EAPB, EBF, EFAMA, FIA, ICI, ISDA, SIFMA AMG) welcome the Commission's decision to grant a time-limited equivalence decision in respect of UK CCPs. However, when this time-limited equivalence decision expires on 30 June 2022, there remains a significant risk of disruption to clearing for EU firms and to their access to global markets.

3 Questions to Christophe Binet on LIBOR Transition

Q #1 When will LIBOR phase out and which rates will be replacing it?

The London Interbank Offered Rate, also known as LIBOR®, is a widely-used index for short-term interest rates that is commonly found in

Global Memo: Benchmark Data Costs

A key purpose of the financial system is to allocate capital and risk in a manner that supports sustainable economic development and growth, including through the provision of financing, investment and hedging products. Financial benchmarks/indices are fundamental to the functioning of financial markets and are widely used in both retail and wholesale markets. In particular, benchmarks are a valuable tool helping market participants to set prices, measure performances, or work out amounts payable under financial contracts or instruments.