EFAMA supports the initiatives launched by IOSCO and other regulators (e.g. ESMA, FCA, SEC) to analyse and address the significant issues concerning market data in the secondary equity market.

MiFID / MiFIR

The Markets in Financial Instruments Directive (MiFID) is a cornerstone of EU financial services legislation and is of direct relevance to asset management companies. In 2014, the European Commission adopted new rules revising MiFID, consisting of a Directive (MiFID II) and a regulation (MiFIR). Overall, MiFID II yielded positive results in terms of liquidity and transparency for investors.

Among possible improvements to the MiFID framework, EFAMA encourages the creation of a well-structured, reasonably priced consolidated tape managed by ESMA and fed by all trading venues and systematic internalisers for all financial instruments. A second, long-term EFAMA objective is better enforcement of data providers’ existing obligation to provide market data on a “reasonable commercial basis”.

EFAMA responds to IOSCO Consultation on Market Data in Secondary Equity Market

EFAMA reply to ESMA CP on marketing communications guidelines

EFAMA believes that ESMA’s draft ‘marketing communication’ Guidelines still require important clarifications to ensure full alignment between them and MiFID II’s Commission Delegated Regulation Article 44. This alignment is essential to ensure coherent rules for fund management companies and distributors. Unfortunately, parts of the proposed Guidelines are overly prescriptive and may unintentionally make some marketing materials vaguer or even inconsistent with local MiFID requirements for distributors.

EFAMA's reply to ESMA's CP on the Guidelines on the MiFID II / MiFIR Obligations on Market Data

EFAMA welcomes this ESMA initiative and we agree with the conclusions in the ESMA Report that there is an overall need to strengthen the laws applicable to data in connection with the MiFIDII/MiFIR Review, aside the implementation of a Consolidated Tape . We consider that the draft Guidelines will further strengthen the MiFID level 1 and level 2 measures and will foster the establishment of a cost-based approach for market data procurement. Therefore, we would be in favour of turning the proposed guidelines into binding regulation.

EFAMA welcomes proposal on affordable consolidated tape - The association continues to urge action on market data costs

EFAMA is pleased to read today the details of a robust MiFIR proposal from the European Commission addressing key areas of reform around the creation of a consolidated tape (CT), along with adjustments to transparency requirements on trading.

Buy-side use-cases for a real-time consolidated tape

A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues.

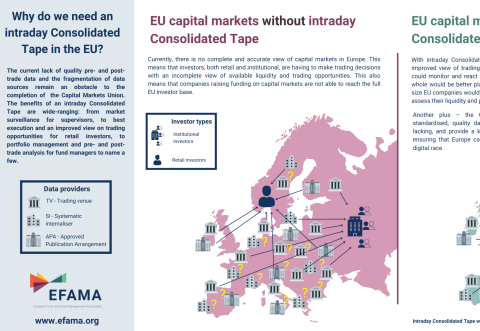

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

Buy-side use-cases for a real-time consolidated tape

A real-time consolidated tape, provided it is made available at a reasonable cost, will bring many benefits to European capital markets. A complete and consistent view of market-wide prices and trading volumes is necessary for any market, though this is especially true for the EU where trading is fragmented across a large number of trading venues. A real-time consolidated tape should cover equities and bonds, delivering data in ‘as close to real-time as technically possible’ after receipt of the data from the different trade venues.

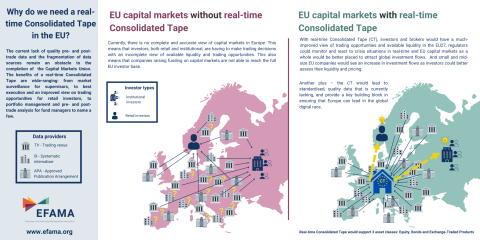

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

Investment Funds Distributor Due Diligence Questionnaire

Funds face unique challenges in performing intermediary oversight, and especially so because of MiFID II requirements, changing regulatory landscapes, and the absence of an industry agreed-upon standard between funds and their distribution channels. To help address these challenges, a dedicated working group developed a uniform due diligence questionnaire (DDQ) that will serve as the standard for investment funds (UCITS and AIFs) in performing onboarding and ongoing oversight of distribution channels.