Data

In the modern economy, data is increasingly becoming a strategic asset. This is particularly true for the asset management industry, where data forms the backbone of the daily activities and internal processes necessary to guarantee best practices in portfolio management.

Asset managers are major users of a variety of data, including market data, index data and, increasingly, ESG data. EFAMA advocates for, and seeks to support members’ access to, high-quality, standardised and comparable data at a fair price. EFAMA also encourages the creation of a well-structured, reasonably priced consolidated tape fed by all trading venues and systematic internalisers for all financial instruments.

EFAMA’s response to ESMA’s CP on data costs and consolidated tape

EFAMA's reply to ESMA's CP on RTS specifying the scope of the consolidated tape for non-equity financial instruments

EFAMA supports every efforts made to enhance financial markets regulation which reinforces the stability and the transparency of the financial system.

In that perspective, EFAMA welcomes the opportunity to comment on the ESMA Consultation Paper on RTS specifying the scope of the consolidated tape for non-equity financial instruments. We consider that a consolidate tape (“CT”) is a key positive factor for price formation and transparency.

Prior to replying to the consultation, we wish to make the following general remarks

An appropriately constructed Consolidated Tape could help to build deeper and more open capital markets in Europe

EFAMA and EFSA welcome the publication of a Market Structure Partners Study on the Creation of an EU Consolidated Tape which addresses the challenges, demand, benefits and proposed architecture for consolidating European financial market data.

European Money Market Funds navigated the Covid 19 crisis successfully

The European Fund and Asset Management Association (EFAMA) has published its second Market Insights highlighting the major trends shaping the European Money Market Fund (MMF) landscape since the entry into force of the Money Market Fund Regulation (MMFR).

Joint associations Global Memo on Market Data Costs

In a report released today, the International Council of Securities Associations (ICSA), the European Fund and Asset Management Association (EFAMA), and the Managed Funds Association (MFA) call for the implementation of internationally recognized principles to address excessively high market data fees and unfair licensing provisions.

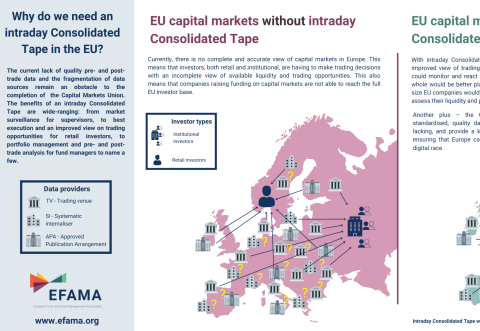

Visual | Why do we need a real-time Consolidated Tape in the EU?

The current lack of quality pre- and post-trade data and the fragmentation of data sources remain an obstacle to the completion of the Capital Markets Union. The benefits of a real-time Consolidated Tape are wide-ranging: from market surveillance for supervisors, to best execution and an improved view on trading opportunities for retail investors, to portfolio management and pre- and post-trade analysis for fund managers to name a few.

Global Memo: Benchmark Data Costs

A key purpose of the financial system is to allocate capital and risk in a manner that supports sustainable economic development and growth, including through the provision of financing, investment and hedging products. Financial benchmarks/indices are fundamental to the functioning of financial markets and are widely used in both retail and wholesale markets. In particular, benchmarks are a valuable tool helping market participants to set prices, measure performances, or work out amounts payable under financial contracts or instruments.

Market Insights | Issue #4 | ESG investing in the UCITS market: a powerful and inexorable trend

The report looks at the major trends in the ESG UCITS market, the impact of the coronavirus pandemic, and the behaviour of ESG and non-ESG funds.